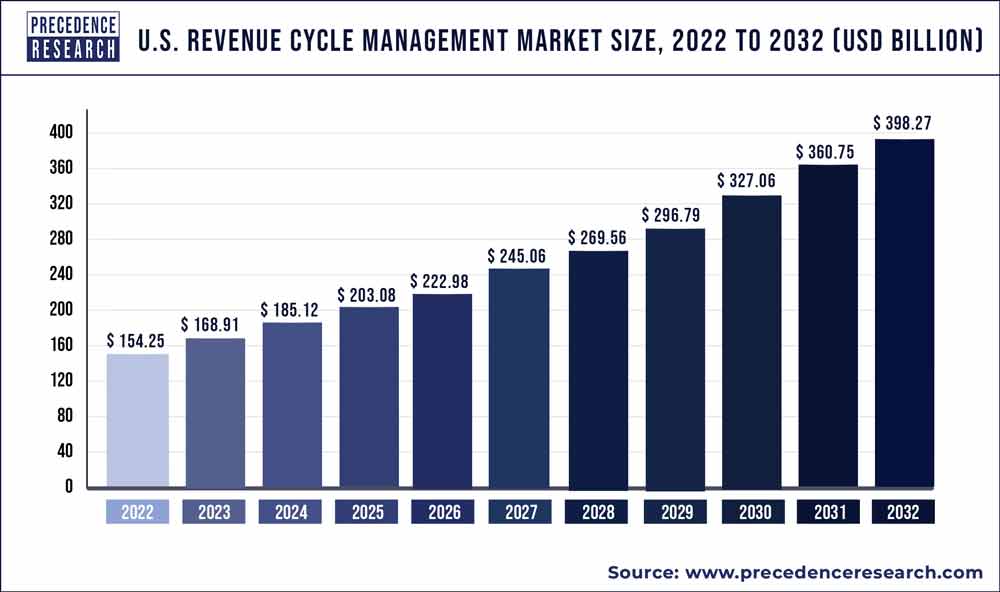

The U.S. revenue cycle management market size surpassed USD 154.25 billion in 2022 and is expected to hit around USD 398.27 billion by 2032, poised to grow at a CAGR of 10% from 2023 to 2032.

U.S. Revenue Cycle Management Market Key Highlights

- In 2022, the services segment accounted for 66% of revenue.

- By product category, the integrated system segment has a revenue share of roughly 72%.

- By delivery method, the web-based delivery mode sector accounted for 55.4% of sales in 2022.

- The hospitals segment has the largest revenue share by end user, accounting for around 56%.

- By physician specialty, the others segment had a revenue share of roughly 71% in 2022.

- In 2022, the in-house segment accounted for 70.5% of total revenue.

Get a Sample: https://www.precedenceresearch.com/sample/2431

Key Drivers of the U.S. Revenue Cycle Management Market

Technological Advancements

The adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain is revolutionizing the RCM market. These technologies enhance the accuracy and efficiency of billing processes, reduce errors, and streamline administrative tasks.

Regulatory Changes

Healthcare regulations in the U.S. are constantly evolving, with significant impacts on the RCM market. The implementation of the Affordable Care Act (ACA) and the transition to Value-Based Care (VBC) models are compelling healthcare providers to optimize their revenue cycle processes to ensure compliance and maximize reimbursements.

Increasing Healthcare Costs

The rising costs of healthcare services in the U.S. are driving the demand for efficient RCM solutions. Providers are under pressure to manage their revenue cycles more effectively to maintain financial stability and continue delivering high-quality care.

Read another Report: Anesthesia Devices Market Size to Hit USD 34.29 Billion by 2033

Challenges Facing the RCM Market

Complexity of Healthcare Billing

Healthcare billing is notoriously complex, involving numerous codes and regulations. The transition to the International Classification of Diseases, Tenth Revision (ICD-10) has added to this complexity, making it essential for providers to have robust RCM systems in place.

Data Security Concerns

The sensitive nature of healthcare data makes it a prime target for cyberattacks. Ensuring the security and privacy of patient information is a major challenge for RCM providers, who must comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA).

Integration Issues

Integrating RCM solutions with existing Electronic Health Records (EHR) and other healthcare IT systems can be challenging. Seamless integration is crucial for achieving the full benefits of RCM, including improved data accuracy and operational efficiency.

Opportunities in the U.S. RCM Market

Growth of Telehealth

The expansion of telehealth services, accelerated by the COVID-19 pandemic, presents significant opportunities for the RCM market. Telehealth requires specialized billing and coding processes, creating a demand for advanced RCM solutions tailored to this mode of care delivery.

Adoption of Automation

Automation is playing an increasingly vital role in RCM, with solutions that automate tasks such as claim submission, payment posting, and denial management. These solutions not only reduce administrative burdens but also improve accuracy and speed up the revenue cycle.

Emerging Markets

There is a growing demand for RCM solutions in emerging markets within the U.S., particularly among smaller healthcare providers and rural hospitals. These entities often lack the resources to manage their revenue cycles effectively, making them prime candidates for RCM services.

Competitive Landscape of the U.S. RCM Market

Major Players

The U.S. RCM market is dominated by several key players, including Optum360, Cerner Corporation, McKesson Corporation, and GE Healthcare. These companies offer comprehensive RCM solutions that cater to the diverse needs of healthcare providers.

Innovative Startups

In addition to established players, innovative startups are entering the RCM market, bringing fresh perspectives and cutting-edge technologies. Companies like VisitPay and Collectly are leveraging AI and machine learning to offer innovative solutions that enhance patient engagement and streamline payment processes.

Strategic Partnerships

Strategic partnerships and acquisitions are common in the RCM market, as companies seek to expand their capabilities and market reach. For instance, the acquisition of Change Healthcare by UnitedHealth Group highlights the ongoing consolidation in the industry, aimed at creating more integrated and comprehensive RCM solutions.

Future Trends in Revenue Cycle Management

Shift to Value-Based Care

The shift from fee-for-service to value-based care models is expected to continue, driving the need for RCM solutions that support these new payment structures. Providers will need systems that can handle complex reimbursement models, including bundled payments and shared savings programs.

Increased Focus on Patient Experience

Enhancing the patient experience is becoming a priority for healthcare providers, and RCM plays a crucial role in this effort. Solutions that offer transparent billing, easy payment options, and effective communication with patients are gaining traction.

AI and Predictive Analytics

The use of AI and predictive analytics in RCM is poised to grow, offering predictive insights that help providers optimize their revenue cycles. These technologies can identify trends, predict denials, and suggest corrective actions, ultimately improving financial outcomes.

U.S. Revenue Cycle Management Market Companies

- Allscripts Healthcare Solutions

- Change Healthcare Inc.

- Cognizant Technology Solutions Corp.

- Computer Programs and Systems Inc.

- Experian Plc

- Medical Information Technology Inc.

- MEDIREVV

- OSP Labs

- Quest Diagnostics Inc.

- R1 RCM Inc.

Segments Covered in the Report

By Product

- Software

- Services

By Type

- Integrated

- Standalone

By Function

- Product Development

- Member Engagement

- Network Management

- Care Management

- Claims Management

- Risk and Compliances

By Delivery Mode

- Web based

- Cloud based

By Physician Specialty

- Oncology

- Cardiology

- Anesthesia

- Radiology

- Pathology

- Pain Management

- Emergency Service

- Others

By Sourcing

- In-house

- External RCM Apps/ Software

- Outsourced RCM Services

By End User

- Physician Back office,

- Hospitals

- Diagnostic Laboratories

- Other

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2431