Robotic Process Automation Market Size

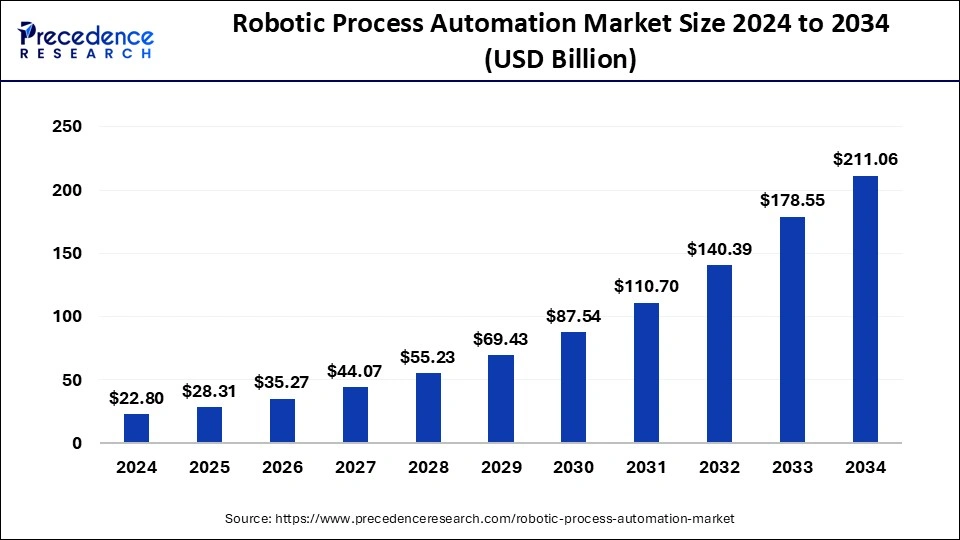

The global robotic process automation market size was estimated at USD 18.41 billion in 2023 and is projected to hit around USD 178.55 billion by 2033, growing at a CAGR of 25.7% from 2024 to 2033.

Robotic Process Automation Market Key Pointers

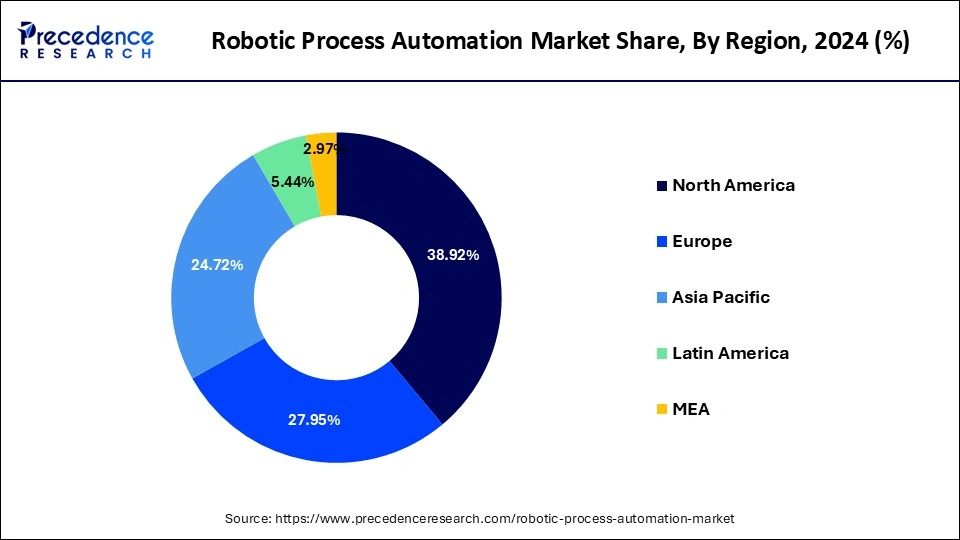

- In 2023, the revenue share attributed to the North American market was 39.34%.

- In 2023, the service segment had a revenue share of 77.46% by type.

- In 2023, the on-premise category accounted for about 68.45% of revenue share by deployment.

- In terms of industry, the BFSI sector brought in 36.81% of revenue in 2023.

Get a Sample: Robotic Process Automation Market Size Projected to Reach USD 178.55 Billion By 2033

Robotic Process Automation Market Growth Factors

The growth of the Robotic Process Automation (RPA) market is propelled by the increasing demand for workflow automation to streamline business operations and reduce manual errors drives adoption across industries. Secondly, the advancements in artificial intelligence and machine learning technologies enable more sophisticated RPA solutions capable of handling complex tasks. Thirdly, the need for cost reduction and operational efficiency encourages organizations to invest in RPA to automate repetitive tasks, thereby freeing up human resources for higher-value activities.

Additionally, the growing trend of digital transformation initiatives further fuels the expansion of the RPA market as companies seek to modernize their processes for enhanced productivity and competitiveness. Lastly, the COVID-19 pandemic has accelerated the adoption of RPA as businesses strive to adapt to remote work environments and mitigate disruptions, leading to increased reliance on automation technologies.

Robotic Process Automation Market Regional Stance

The U.S. robotic process automation market is projected to soar from USD 6.53 billion in 2023 to USD 54.83 billion by 2033, with a steady growth rate of 23.90% from 2024 onwards. North America dominates with a 39.34% share in 2023, driven by the U.S., a key innovator and adopter of robotics. The region’s increased robotic usage enhances competitiveness and job opportunities, especially in manufacturing. Asia Pacific is poised to witness the fastest growth, fueled by rising adoption in diverse sectors like pharma, healthcare, IT, retail, and manufacturing. Europe, China, South Korea, and Germany also show significant market expansion, driven by increasing automation demand and technological advancements.

Robotic Process Automation Market Segment Highlights

- Type Insights:

- Market classified into software and service.

- Service segment dominates with over 77.46% market share in 2023.

- Expected to be the fastest growing due to demand for outsourcing RPA and cloud-based automation.

- Service providers improving advising, training, and consulting services to compete.

- RPA as a service aids in identifying automation possibilities and vendor selection.

- Robotic Process Automation Market Share, By Type, 2023 (%):

- Software category: 22.54% revenue share in 2023.

- Anticipated consistent growth due to remote working needs and internal data control.

- Deployment Insights:

- Market divided into on-premises and cloud deployment.

- On-premises sector leads with over 68.44% revenue share in 2023.

- Expected steady growth from 2023 to 2032.

- Robotic Process Automation Market Share, By Deployment, 2023 (%):

- Cloud sector projected to exceed 9% revenue share in 2022.

- Anticipated fastest-growing category due to cost benefits and operational flexibility.

- Industry Insights:

- BFSI segment holds largest market share of 36.81% in 2023.

- RPA used in banking for regulatory reporting and insurance for transaction control.

- Healthcare industry expected to grow rapidly, utilizing RPA for administrative processes and patient care.

- Example: UiPath software used for loan applications in US Banks.

- Global Robotic Process Automation Market Revenue, by Industry ($Billion) 2021-2023:

- BFSI: $6.778 billion in 2023.

- Pharma & Healthcare: $3.823 billion in 2023.

- Manufacturing: $3.384 billion in 2023.

- Retail & Consumer Goods: $1.726 billion in 2023.

- Information Technology (IT) & Telecom: $1.297 billion in 2023.

- Communication, Media & Education: $0.499 billion in 2023.

- Logistics, Energy & Utilities: $0.381 billion in 2023.

- Construction: $0.189 billion in 2023.

- Others: $0.334 billion in 2023.

Read More Reports: Artificial Intelligence Market Size to Hit USD 2,575.16 Billion by 2032

Robotic Process Automation Market Dynamics

Driver

The increasing demand for automation across various sectors is a significant driver propelling growth in the robotic process automation (RPA) market. As organizations strive to improve operational efficiency, reduce costs, and enhance productivity, there is a growing adoption of RPA solutions to automate repetitive and rule-based tasks across business processes. RPA technology enables organizations to streamline workflows, eliminate manual errors, and accelerate task completion by deploying software robots to mimic human actions and interact with digital systems and applications.

Moreover, with the proliferation of data-driven decision-making and digital transformation initiatives, there is a greater need for RPA solutions that can integrate with existing IT infrastructure, enterprise applications, and cloud-based platforms to optimize business processes and drive innovation.

Additionally, as industries such as finance, healthcare, manufacturing, and retail increasingly embrace automation to stay competitive in the global market, there is a rising demand for RPA solutions that offer scalability, flexibility, and security. This trend underscores the significant opportunities for growth and expansion within the RPA market as organizations across sectors recognize the value of automation in achieving operational excellence and driving business outcomes in an increasingly digital world.

Restraint

The lack of standardized or well-defined processes across industries poses a significant challenge for the robotic process automation (RPA) market. RPA technology, which automates repetitive and rule-based tasks by mimicking human interactions with digital systems, offers tremendous potential for efficiency gains, cost savings, and scalability across various sectors. However, the diversity of business processes, systems, and workflows across industries presents challenges for RPA implementation and scalability.

In many cases, organizations lack standardized processes or well-defined workflows, making it challenging to identify suitable automation opportunities or develop RPA solutions that can be easily deployed and scaled across different departments or business units. Moreover, legacy systems, siloed data, and heterogeneous IT environments further complicate RPA deployment and integration efforts.

Addressing the lack of standardized processes requires a strategic approach to RPA implementation, focusing on process discovery, analysis, and optimization. Organizations can leverage process mining tools and methodologies to analyze and visualize existing workflows, identify inefficiencies, and prioritize automation opportunities based on factors such as complexity, frequency, and potential return on investment.

Additionally, developing a robust governance framework and change management strategy is essential to standardize processes, establish best practices, and ensure alignment with organizational goals and compliance requirements. Collaboration among business stakeholders, IT teams, RPA vendors, and industry associations can facilitate knowledge sharing, benchmarking, and the development of industry-specific RPA frameworks and standards.

Furthermore, investing in RPA platforms with built-in capabilities for process discovery, cognitive automation, and analytics can streamline implementation and scalability across diverse industries. These platforms should offer flexibility, scalability, and ease of integration with existing systems and workflows to support agile RPA deployment and adaptation to evolving business needs.

By addressing the lack of standardized processes and promoting best practices in RPA implementation, stakeholders in the RPA market can unlock the full potential of automation technologies to drive digital transformation, innovation, and competitive advantage across industries.

Opportunity

The increased demand for Robotic Process Automation (RPA) in Business Process Outsourcing (BPO) is reshaping the landscape of the robotic process automation market, driving adoption across various industries and business functions. RPA technology, which uses software robots or “bots” to automate repetitive, rules-based tasks and processes, offers significant benefits for BPO providers and their clients, including increased efficiency, cost savings, and scalability.

One key driver of the increased demand for RPA in BPO is the need for greater operational efficiency and productivity in a highly competitive business environment. BPO providers are under pressure to deliver high-quality services at lower costs and faster turnaround times to meet client expectations and maintain profitability. RPA enables BPO providers to automate routine tasks such as data entry, document processing, invoice generation, and customer service inquiries, freeing up human resources to focus on higher-value activities that require human judgment and creativity.

Moreover, the scalability and flexibility of RPA technology make it well-suited for BPO providers operating in dynamic and rapidly evolving industries. RPA bots can be easily deployed and scaled up or down to accommodate fluctuations in workload volumes, seasonal demand, or changes in business requirements, providing BPO providers with greater agility and responsiveness to client needs.

Additionally, RPA offers significant cost-saving opportunities for BPO providers by reducing labor costs, minimizing errors, and improving process efficiency. By automating repetitive tasks that were previously performed manually by human workers, RPA helps BPO providers lower operational costs, improve productivity, and enhance overall profitability, making them more competitive in the market.

Furthermore, RPA enables BPO providers to deliver enhanced customer experiences by accelerating process cycle times, improving accuracy, and ensuring consistency in service delivery. By automating routine tasks and streamlining workflows, RPA helps BPO providers deliver faster response times, reduce processing errors, and provide more personalized and efficient service to their clients and end customers.

Robotic Process Automation Market Leading Players

- UiPath

- Automation Anywhere

- Blue Prism

- NICE

- Pegasytems

- Celaton Ltd.

- KOFAX, Inc.

- NTT Advanced Technology Corp.

- EdgeVerve Systems Ltd.

- FPT Software

- OnviSource, Inc.

- HelpSystems

- Xerox Corporation

Segments Covered in the Report

By Type

- Software

- Service

- Consulting

- Implementing

- Training

By Deployment

- Cloud

- On-Premise

By Industry

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics, and Energy & Utilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1348