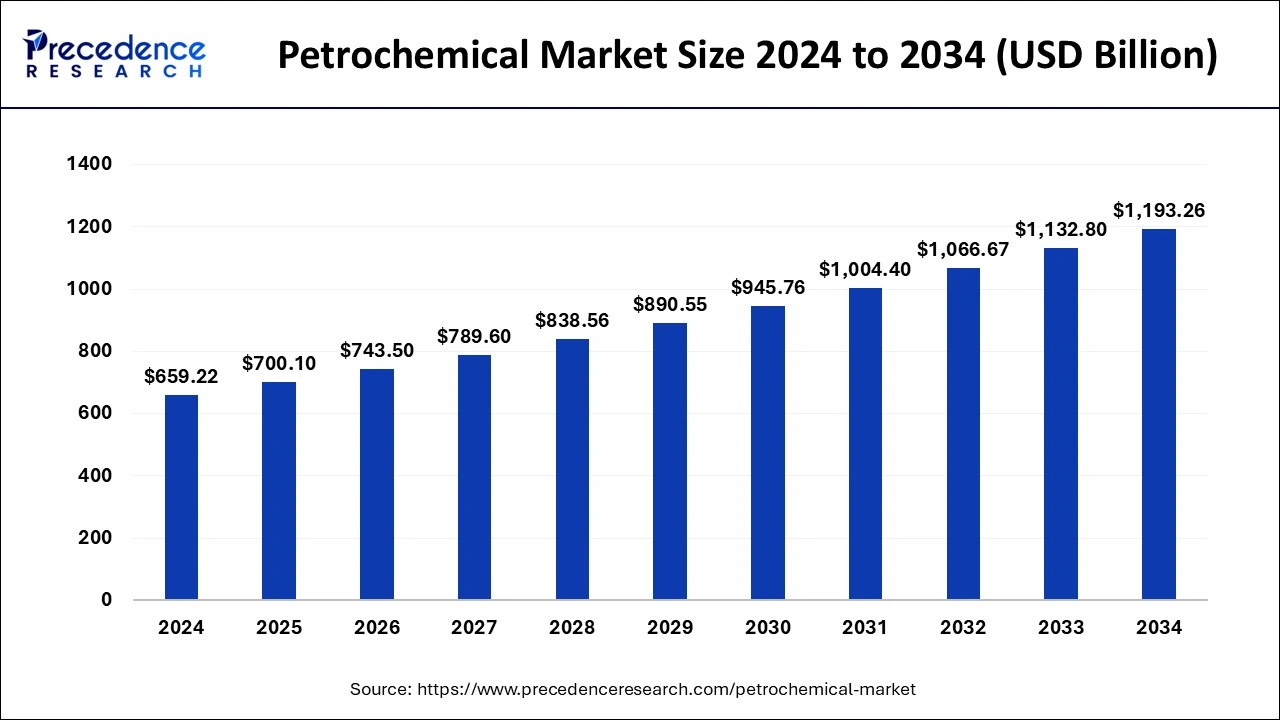

The global petrochemical market is experiencing robust growth, with its size valued at USD 620.74 billion in 2023 and projected to reach approximately USD 1,132.80 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2033. This article delves into key market segments, regional insights, and the driving factors behind this growth.

Key Takeaways

Product Segmentation

Ethylene Segment

The ethylene segment is a major component of the petrochemical market, capturing a significant revenue share of 40.6% in 2023. Ethylene is an essential raw material used in the production of various products, including plastics, textiles, and chemicals. Its demand is driven by its extensive use in manufacturing polyethylene, which is widely used in packaging, containers, and household products. The segment’s growth is also supported by advancements in production technologies and the increasing use of ethylene in emerging applications such as bio-based plastics and green chemicals.

Methanol Segment

The methanol segment is expected to grow at a CAGR of 7.9% from 2024 to 2033. Methanol is used as a feedstock in the production of formaldehyde, acetic acid, and various other chemicals. It is also utilized as a fuel and in fuel additives, which contributes to its rising demand. The growth of the methanol segment is fueled by the increasing use of methanol-to-olefins (MTO) technology, which converts methanol into valuable olefins used in plastic production. Additionally, methanol’s role in the energy sector, particularly in the production of biodiesel and as a hydrogen carrier, supports its market expansion.

Get a Sample: https://www.precedenceresearch.com/sample/1193

Regional Insights

Asia Pacific

The Asia Pacific region dominated the petrochemical market with a revenue share of 52.14% in 2023 and is anticipated to grow at a CAGR of 6.5% from 2024 to 2033. The region’s rapid industrialization and urbanization, especially in China and India, drive the demand for petrochemical products. The construction, automotive, and manufacturing industries in these countries heavily rely on petrochemicals for their operations. The growing population and rising disposable incomes in the region further boost the demand for consumer goods and packaging materials, which are major end-uses of petrochemicals. The expansion of production capacities and significant investments in petrochemical plants in the Asia Pacific region also contribute to its market dominance.

Europe

Europe is projected to grow at a CAGR of 5.7% during the forecast period. The region’s petrochemical market is driven by the demand for sustainable and high-performance materials in various industries, including automotive, aerospace, and construction. European countries are focusing on reducing carbon emissions and promoting the use of bio-based and recycled materials, which stimulates innovation and investment in the petrochemical sector. Additionally, the presence of well-established chemical companies and a strong focus on research and development support the market’s growth in Europe.

North America

The North American petrochemical market size was estimated at USD 106.77 billion in 2023 and is forecasted to expand to USD 211.83 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033. The region benefits from abundant natural gas supplies, which serve as a cost-effective feedstock for petrochemical production. The shale gas revolution has significantly boosted the competitiveness of North American petrochemical producers. The region’s market growth is also driven by increasing investments in new production facilities and the expansion of existing plants. Furthermore, the growing demand for lightweight and high-performance materials in the automotive and construction sectors supports the petrochemical market in North America.

Yearly Market Size (USD Billion)

- 2024: 114.37

- 2025: 122.52

- 2026: 131.23

- 2027: 140.55

- 2028: 150.52

- 2029: 161.19

- 2030: 172.60

- 2031: 184.81

- 2032: 197.87

- 2033: 211.83

Read Report: Coating Resins Market Size to Hit USD 87.55 Billion by 2032

Key Market Insights

Growth Factors

Global Population Growth and Urbanization

The increasing global population and rapid urbanization drive the demand for a wide range of petrochemical products, including chemicals, polymers, and plastics. In emerging nations, petrochemical products are extensively used in manufacturing, construction, and other industrial processes due to economic growth and industrialization. The construction boom in urban areas increases the demand for construction materials, insulation, and piping, all of which are derived from petrochemicals. Additionally, the rising middle class in developing countries boosts the demand for consumer goods, electronics, and packaging, further driving the petrochemical market.

Technological Developments

Technological advancements in petrochemical production processes result in lower production costs, improved efficiency, and the development of innovative products. Advanced catalytic processes, such as fluid catalytic cracking (FCC) and steam cracking, enhance the yield and quality of petrochemical products. Innovations in process optimization, energy management, and waste reduction contribute to the sustainability and profitability of petrochemical operations. Furthermore, the integration of digital technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), enhances operational efficiency, predictive maintenance, and supply chain management in the petrochemical industry.

Raw Material Availability

The price and accessibility of raw materials, such as natural gas and crude oil, significantly impact the cost of producing petrochemicals. Regions with easy access to feedstock are frequently at a competitive advantage. For instance, the shale gas revolution in the United States has provided a cost-effective feedstock for ethylene production, boosting the competitiveness of North American producers. Similarly, the Middle East’s abundant natural gas reserves support the region’s petrochemical industry. The availability of low-cost feedstocks enables petrochemical companies to achieve higher profit margins and invest in capacity expansions.

Research and Development Investments

Investments in research and development (R&D) stimulate growth and innovation in the petrochemical sector by facilitating the creation of new technologies, processes, and products. Companies are investing in R&D to develop more efficient catalysts, optimize production processes, and create sustainable materials. Collaborative efforts between industry players, research institutions, and governments promote technological advancements and address environmental challenges. For example, the development of bio-based polymers and recyclable materials aligns with the increasing focus on sustainability and circular economy principles in the petrochemical industry.

Environmental Regulations

Strict emissions and waste disposal regulations, coupled with growing public awareness of environmental issues, encourage the petrochemical sector to develop more environmentally friendly and sustainable methods. Companies are investing in technologies to reduce greenhouse gas emissions, improve energy efficiency, and minimize waste generation. Regulatory frameworks, such as carbon pricing and emission trading systems, drive the adoption of cleaner production processes. The shift towards circular economy practices, such as chemical recycling and the use of renewable feedstocks, also supports the industry’s sustainability goals.

Shifting Consumer Trends

Shifting consumer trends and preferences, such as the increasing demand for eco-friendly or biobased products, influence the types of petrochemical products in demand. Consumers are becoming more conscious of the environmental impact of products and are seeking sustainable alternatives. This trend drives the development and adoption of bio-based polymers, biodegradable materials, and recyclable plastics. Companies are responding to consumer preferences by offering products with reduced carbon footprints and improved environmental profiles. The growing popularity of electric vehicles, which require lightweight materials and advanced polymers, further supports the demand for innovative petrochemical products.

Global Energy Price Fluctuations

Fluctuations in global energy prices, particularly those of natural gas and crude oil, can impact the cost structure of the petrochemical industry, affecting investment decisions and profitability. Volatile energy prices influence feedstock costs, operating expenses, and product pricing. Companies need to manage risks associated with energy price fluctuations through strategic sourcing, hedging, and operational efficiency measures. The ability to adapt to changing energy market dynamics and optimize production processes is crucial for maintaining competitiveness in the petrochemical industry.

COVID-19 Impact on Global Petrochemical Market

The outbreak of COVID-19 affected most industries operating across the globe, including the petrochemical sector. Lockdowns and restrictions implemented by leading countries disrupted supply chains and production activities. The irregular supply of raw materials and reduced demand from end-use industries impacted petrochemical production. The pandemic also led to fluctuations in oil prices, affecting feedstock availability and costs. However, as economies recover and industrial activities resume, the petrochemical market is expected to regain momentum. The pandemic has also accelerated the adoption of digital technologies and sustainability practices in the industry, paving the way for future growth and resilience.

Future of Global Petrochemical Market

Leading players in the global petrochemical industry are focusing on increasing production capacity to enhance their market position and gain a competitive edge. Significant investments are being made in regions such as Asia Pacific, the United States, and the Middle East to expand processing capacity and meet rising consumer demand. The construction of new petrochemical plants and the modernization of existing facilities are driving market growth. For instance, between 2016 and 2018, around 280 new petrochemical projects were announced, representing a year-over-year increase of 42%. These investments are expected to have a substantial impact on the growth of the petrochemical industry, supporting the production of primary chemicals and advanced materials.