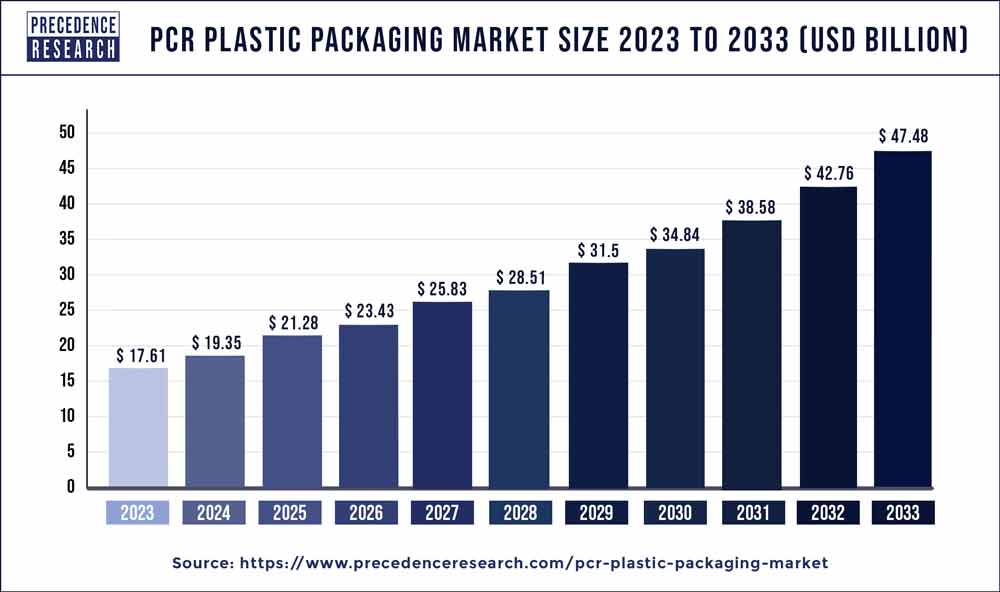

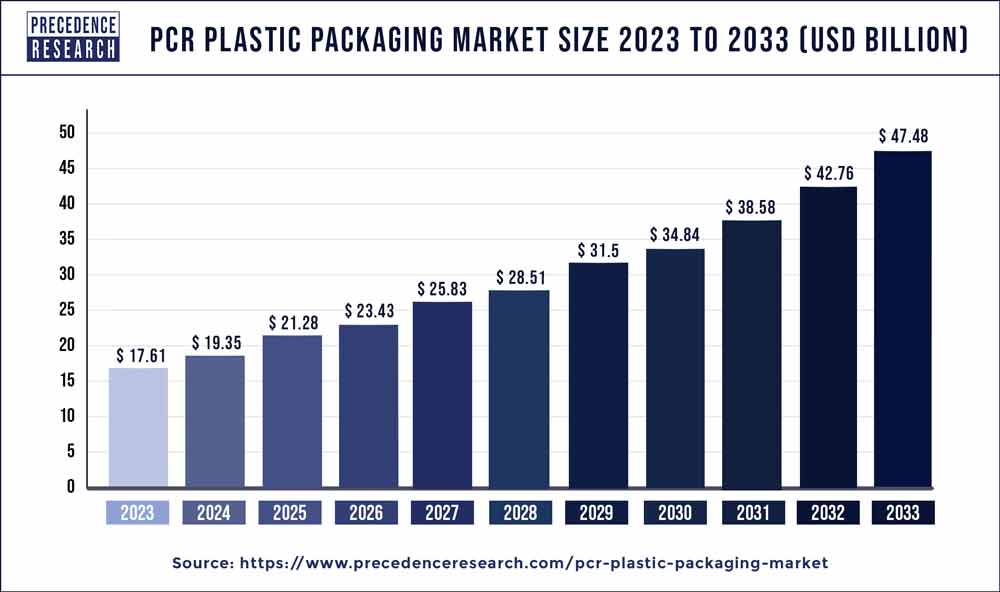

The global PCR plastic packaging market size surpassed USD 17.61 billion in 2023 and is expected to hit around USD 47.48 billion by 2033, poised to grow at a CAGR of 10.49% from 2024 to 2033.

PCR Plastic Packaging Market Key Highlights

- In 2023, North America held the highest market share, accounting for 35.68%.

- Asia Pacific is expected to expand at a quick pace over the predicted period.

- In terms of material, the PET category had the largest share (33% in 2023).

- By material, the PVC segment is likely to increase at a considerable CAGR over the forecast period.

- In 2023, the bottle segment had the biggest market share (42.78%).

- In 2023, the food and beverage category accounted for the largest proportion of the PCR plastic packaging market, with 57.18%.

- By end-user, the cosmetic category is likely to increase at a substantial CAGR throughout the forecasted period.

Get a Sample: https://www.precedenceresearch.com/sample/3476

PCR Plastic Packaging Market Overview

The Post-Consumer Recycled (PCR) plastic packaging market has seen significant growth in recent years due to increasing environmental awareness and stringent regulations aimed at reducing plastic waste. PCR plastics are made from recycled plastic products, primarily collected from consumers. These materials are processed and repurposed into new packaging products, reducing the demand for virgin plastic and helping to close the loop in the circular economy.

Future Trends in PCR Plastic Packaging

The future of the PCR plastic packaging market looks promising, with several trends likely to shape its trajectory:

Increased Investment in Recycling Infrastructure

To meet the growing demand for PCR plastics, there will be substantial investments in recycling infrastructure. Governments and private entities are likely to collaborate in enhancing collection, sorting, and processing facilities, ensuring a steady supply of high-quality PCR plastics.

Innovations in Packaging Design

Packaging design will evolve to accommodate the characteristics of PCR plastics. This includes creating products that are easier to recycle, using less material without compromising functionality, and designing for multiple uses. Innovative designs will further integrate sustainability into the packaging lifecycle.

Collaborations and Partnerships

Collaboration between brands, recyclers, and governments will be pivotal. Such partnerships can streamline the recycling process, share best practices, and develop standardized protocols for the use of PCR plastics. These cooperative efforts will strengthen the market and drive innovation.

Read another Report: Anti-counterfeit Packaging Market Size to Surpass USD 484.97 Billion By 2033

PCR Plastic Packaging Market Dynamics

Drivers

- Growing Environmental Awareness: Increasing awareness about environmental sustainability and the need to reduce plastic waste are driving the demand for PCR (Post-Consumer Recycled) plastic packaging. Both consumers and businesses are showing a growing preference for eco-friendly packaging options.

- Government Regulations and Policies: Governments worldwide are implementing stringent regulations and policies to promote the use of recycled materials. These regulations encourage companies to adopt PCR plastics in their packaging solutions.

- Corporate Sustainability Goals: Many companies are setting ambitious sustainability goals to reduce their environmental footprint. Using PCR plastics in packaging helps companies meet these targets and improve their corporate image.

- Technological Advancements: Advances in recycling technologies are improving the quality and efficiency of PCR plastic production. This makes PCR plastics a more viable and attractive option for packaging.

- Consumer Demand for Sustainable Products: There is growing consumer demand for products that come in sustainable packaging. Brands that use PCR plastic packaging can attract environmentally conscious consumers.

Restraints

- Quality and Performance Issues: PCR plastics can sometimes have lower performance characteristics compared to virgin plastics. Issues such as durability, clarity, and consistency can pose challenges for their adoption in certain packaging applications.

- Cost Concerns: The cost of producing PCR plastics can be higher than that of virgin plastics, particularly if the supply of high-quality recycled materials is limited. This can deter companies from switching to PCR plastics.

- Supply Chain Challenges: Ensuring a consistent and reliable supply of high-quality PCR materials can be challenging. Variability in the availability of recycled plastics can affect production schedules and costs.

- Limited Awareness and Adoption: Despite growing awareness, some regions and industries still have limited understanding and adoption of PCR plastics. This can slow down market growth in those areas.

Opportunities

- Innovation in Recycling Technologies: Continued innovation in recycling technologies can improve the quality and cost-effectiveness of PCR plastics, making them more competitive with virgin plastics and expanding their use in various packaging applications.

- Expansion into Emerging Markets: Emerging markets present significant growth opportunities for the PCR plastic packaging industry. Increasing industrialization and environmental awareness in these regions can drive demand.

- Brand Differentiation: Companies can leverage PCR plastic packaging as a unique selling proposition to differentiate their products in the market. Highlighting sustainability efforts can attract eco-conscious consumers and build brand loyalty.

- Regulatory Incentives: Governments may offer incentives for the use of recycled materials, such as tax benefits or subsidies, which can offset some of the cost disadvantages and encourage adoption

PCR Plastic Packaging Market Companies

- Berry Global Group, Inc.

- Amcor Limited

- Plastipak Holdings, Inc.

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Huhtamäki Oyj

- DS Smith Plc

- Winpak Ltd.

- Silgan Holdings Inc.

- Coveris Holdings S.A.

- Printpack, Inc.

- Greif, Inc.

- Constantia Flexibles Group GmbH

- ProAmpac Holdings, Inc.

Segments Covered in the Report

By Material

By Product

By End User

- Food, Beverage

- Healthcare

- Cosmetics

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa