Membrane Filtration Market Size and Growth Projections

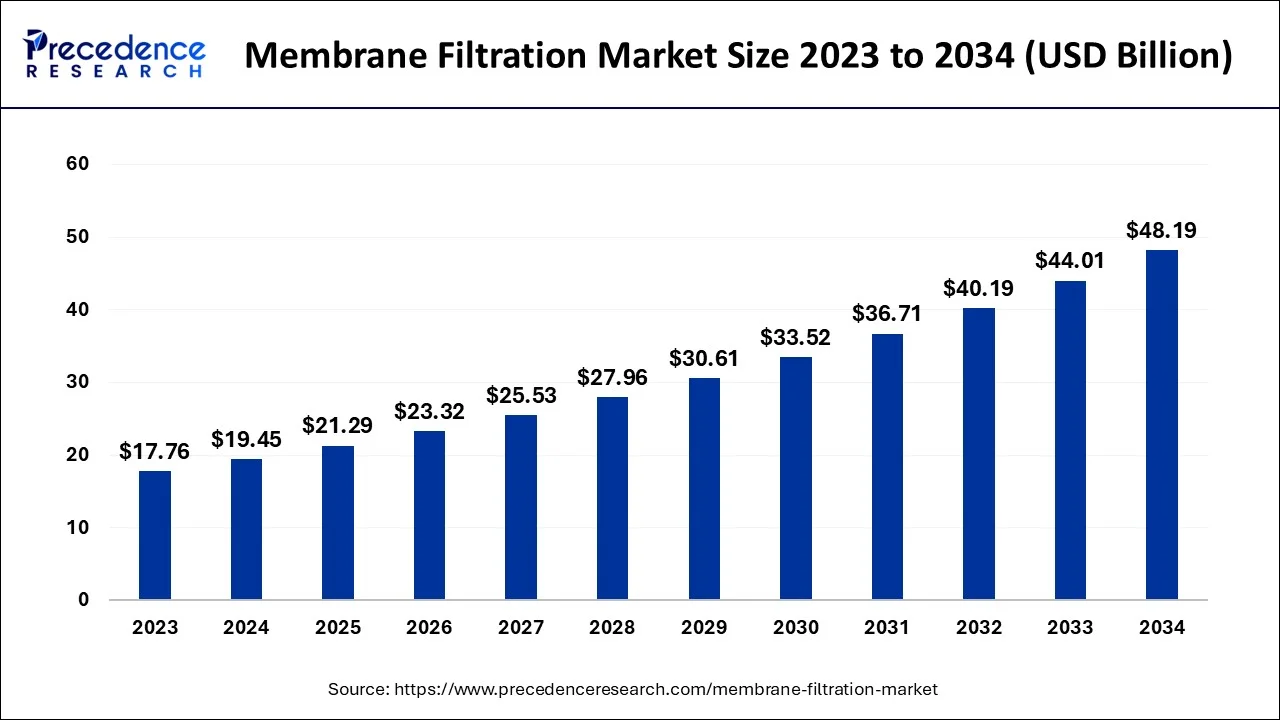

The membrane filtration market was valued at approximately USD 17.76 billion in 2023 and is expected to reach USD 44.02 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.5% during the forecast period. This growth can be attributed to several factors, including the rising demand for clean and safe drinking water, increasing industrial applications, and stringent environmental regulations.

Membrane Filtration Market Introduction

The membrane filtration market has experienced significant growth in recent years, driven by increasing demand for clean water, stringent regulations on water treatment, and advancements in filtration technologies. Membrane filtration is a versatile and effective separation process used in various industries, including water and wastewater treatment, food and beverage, pharmaceuticals, and biotechnology. This article provides a comprehensive analysis of the membrane filtration market, covering market size, growth projections, key drivers, challenges, regional trends, and future opportunities.

Membrane Filtration Market Overview

Membrane filtration involves using semi-permeable membranes to separate particles and impurities from liquids. The technology encompasses various processes, such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, each with different pore sizes and applications. The global membrane filtration market is poised for substantial growth due to its wide range of applications and the increasing need for efficient and sustainable filtration solutions.

Get a Sample: https://www.precedenceresearch.com/sample/1814

Membrane Filtration Market Drivers

- Rising Demand for Clean WaterThe increasing global population and rapid urbanization have led to a higher demand for clean and safe drinking water. Membrane filtration technologies play a crucial role in removing contaminants and pathogens from water sources, ensuring the availability of potable water. The need for reliable water treatment solutions in regions facing water scarcity is a significant driver for the membrane filtration market.

- Stringent Environmental RegulationsGovernments and regulatory bodies worldwide have implemented stringent regulations to control water pollution and ensure the safe disposal of industrial effluents. Compliance with these regulations requires advanced water treatment technologies, such as membrane filtration, to remove harmful substances from wastewater before discharge. This has propelled the adoption of membrane filtration systems across various industries.

- Advancements in Filtration TechnologiesContinuous advancements in membrane materials, module designs, and manufacturing processes have enhanced the efficiency and performance of membrane filtration systems. Innovations such as high-flux membranes, fouling-resistant coatings, and energy-efficient processes have made membrane filtration more cost-effective and reliable, driving its adoption in diverse applications.

- Growing Applications in Food and Beverage IndustryThe food and beverage industry extensively uses membrane filtration for applications such as dairy processing, beverage clarification, and concentration of fruit juices. Membrane filtration helps in maintaining product quality, extending shelf life, and ensuring compliance with food safety standards. The increasing demand for processed and packaged foods has boosted the adoption of membrane filtration in this sector.

Read Report: Gynecological Devices Market Size to Surpass USD 22 Billion By 2033

Membrane Filtration Market Segmentation

The membrane filtration market can be segmented based on technology, application, and region.

By Technology

- Microfiltration (MF): Utilizes membranes with larger pore sizes (0.1-10 micrometers) to remove suspended solids, bacteria, and other particles from liquids.

- Ultrafiltration (UF): Employs membranes with smaller pore sizes (0.01-0.1 micrometers) to separate macromolecules, proteins, and viruses from solutions.

- Nanofiltration (NF): Uses membranes with even smaller pore sizes (0.001-0.01 micrometers) for selective removal of dissolved salts and organic molecules.

- Reverse Osmosis (RO): Involves membranes with the smallest pore sizes (<0.001 micrometers) to achieve the highest level of separation, including desalination and removal of dissolved ions.

By Application

- Water and Wastewater Treatment: Includes municipal water treatment, industrial wastewater treatment, and desalination processes.

- Food and Beverage: Encompasses dairy processing, beverage production, and food ingredient concentration.

- Pharmaceuticals and Biotechnology: Involves purification of drugs, separation of biomolecules, and sterile filtration.

- Others: Includes applications in chemical processing, electronics, and healthcare.

Membrane Filtration Market Regional Trends

- North AmericaNorth America is a significant market for membrane filtration, driven by stringent water quality regulations and the presence of key market players. The United States and Canada have well-established water treatment infrastructure, and ongoing investments in upgrading and expanding these facilities are boosting the demand for membrane filtration technologies. Additionally, the growing awareness of water conservation and reuse is driving the adoption of membrane filtration systems in various industries.

- EuropeEurope is another prominent market for membrane filtration, with countries like Germany, France, and the United Kingdom leading the adoption of advanced water treatment technologies. The European Union’s stringent environmental regulations and sustainability initiatives are key drivers for the market. Moreover, the food and beverage industry in Europe extensively uses membrane filtration for product quality and safety, further contributing to market growth.

- Asia PacificThe Asia Pacific region is experiencing rapid growth in the membrane filtration market, fueled by increasing industrialization, urbanization, and population growth. Countries like China, India, and Japan are investing heavily in water treatment infrastructure to address water scarcity and pollution issues. The expanding food and beverage industry, coupled with rising awareness of water quality, is driving the demand for membrane filtration systems in the region.

- Latin America and Middle East & AfricaThese regions are also witnessing significant growth in the membrane filtration market, driven by the need for clean water and improved wastewater management. Increasing investments in water treatment projects, particularly in Brazil, South Africa, and the Middle East, are creating opportunities for market players. Additionally, the adoption of membrane filtration in the oil and gas industry for produced water treatment is contributing to market growth.

Membrane Filtration Market Challenges and Restraints

- High Initial Investment and Operating CostsThe installation and operation of membrane filtration systems can be costly, especially for small and medium-sized enterprises. The need for regular maintenance, membrane replacement, and energy consumption adds to the overall operating costs. This can be a significant barrier for the adoption of membrane filtration technologies, particularly in developing regions.

- Membrane FoulingMembrane fouling is a common challenge in membrane filtration processes, leading to reduced efficiency and increased maintenance requirements. Fouling occurs due to the accumulation of suspended solids, organic matter, and microorganisms on the membrane surface. While advancements in membrane materials and cleaning techniques have mitigated this issue to some extent, it remains a challenge for the widespread adoption of membrane filtration systems.

- Limited Awareness and Technical ExpertiseIn some regions, the lack of awareness about the benefits of membrane filtration and limited technical expertise hinder the adoption of these technologies. Proper training and knowledge dissemination are essential to overcome these challenges and promote the use of membrane filtration systems across various industries.

Membrane Filtration Market Future Opportunities

- Emerging Applications in New IndustriesThe membrane filtration market is expanding beyond traditional applications into new industries such as pharmaceuticals, biotechnology, and electronics. The growing demand for high-purity water and specialized filtration processes in these industries presents significant opportunities for market growth. For instance, membrane filtration is increasingly used in pharmaceutical manufacturing for the separation and purification of active ingredients.

- Advancements in Membrane MaterialsContinuous research and development efforts are focused on developing advanced membrane materials with improved performance characteristics. Innovations such as nanocomposite membranes, graphene-based membranes, and biomimetic membranes offer enhanced permeability, selectivity, and fouling resistance. These advancements are expected to drive the adoption of membrane filtration technologies in various applications.

- Sustainable and Energy-Efficient SolutionsThe emphasis on sustainability and energy efficiency is driving the development of innovative membrane filtration systems. Manufacturers are exploring renewable energy sources, such as solar and wind, to power filtration processes, reducing the environmental footprint. Additionally, the integration of smart technologies and automation in membrane filtration systems enhances operational efficiency and reduces energy consumption.

- Growing Focus on Water Reuse and RecyclingThe increasing focus on water reuse and recycling presents significant opportunities for the membrane filtration market. Industries and municipalities are adopting advanced treatment technologies, including membrane filtration, to recycle wastewater and reduce freshwater consumption. The implementation of water reuse projects in water-stressed regions is expected to drive the demand for membrane filtration systems.

Membrane Filtration Market Players

The membrane filtration market is characterized by the presence of several key players, including multinational corporations and regional companies. Some of the prominent market players include:

- SUEZ Water Technologies & Solutions: A leading provider of water treatment solutions, SUEZ offers a wide range of membrane filtration products and services for various applications.

- DuPont Water Solutions: DuPont is a global leader in innovative water filtration technologies, offering a comprehensive portfolio of membrane products for water and wastewater treatment.

- Pentair plc: Pentair provides advanced membrane filtration solutions for industrial, residential, and commercial applications, focusing on sustainability and energy efficiency.

- Merck KGaA: Merck is a key player in the pharmaceutical and biotechnology sectors, offering high-performance membrane filtration products for drug manufacturing and laboratory applications.

- Pall Corporation: Pall Corporation specializes in filtration, separation, and purification technologies, providing membrane filtration solutions for diverse industries, including food and beverage, pharmaceuticals, and biotechnology.

Segments covered in the report

By Type

- Reverse osmosis (RO)

- Ultrafiltration (UF)

- Microfiltration (MF)

- Nanofiltration (NF)

By Application

- Water & wastewater

- Food & beverages

- Dairy products

- Drinks & concentrates

- Wine & beer

- Other

By Module Design

- Spiral wound

- Tubular systems

- Plates & frames and hollow fibers

By Membrane Material

- Polymeric

- Ceramic

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1814