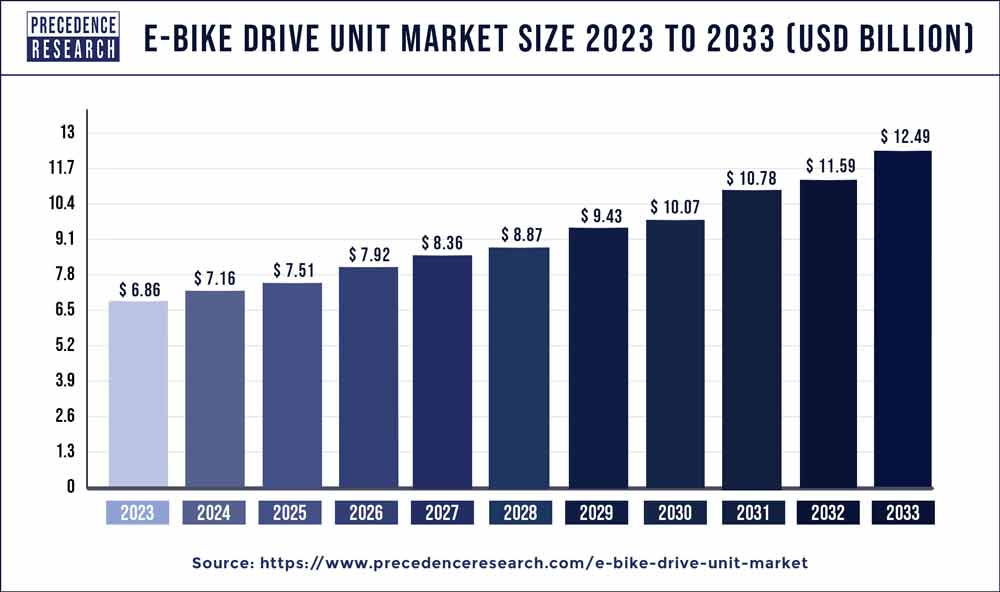

The global E-bike drive unit market size reached USD 6.86 billion in 2023 and is projected to hit around USD 12.49 billion by 2033, expanding at a CAGR of 6.38% from 2024 to 2033.

E-bike Drive Unit Market Key Pointers

- In 2023, Asia Pacific held the largest market share (93.97%), leading the global market.

- In 2023, the hub motors segment had the biggest market share, accounting for 69.02% of the total.

- With a revenue share of 93.2% by application, the OEM segment led the market in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/1160

E-bike Drive Unit Market Concentration:

A few major players hold a significant share of the market. Companies like Bosch, Shimano, Yamaha, Bafang, and Brose are prominent leaders. These established players have brand recognition, strong distribution networks, and technological expertise, giving them an edge.

E-bike Drive Unit Market Competition:

- There’s a growing presence of regional players, particularly in China. These companies offer competitive pricing and cater to specific regional needs.

- New entrants are emerging with innovative technologies, especially focused on lightweight and powerful motors. This injects competition and drives technological advancements.

Related Report: Vehicle-to-Grid Technology Market Size Projected to Reach USD 45.09 Billion By 2033

Regional Stance

E-bike Drive Unit Market Trends

-

Growth of the mid-drive motor segment: Mid-drive motors are located in the center of the bike, near the pedals. This placement offers several advantages over hub motors, which are located in the front or rear wheel. Mid-drive motors provide a more natural riding experience because the weight is distributed more evenly across the bike. They are also generally more powerful and efficient than hub motors, which can improve the range and performance of an e-bike. Additionally, mid-drive motors can be paired with a wider range of gears, which gives riders more control over their pedaling cadence.

-

Increased demand for connectivity: E-bike drive units are becoming increasingly connected, which allows riders to track their rides, monitor their performance, and receive software updates. This connectivity can be beneficial for riders of all levels. For example, recreational riders can use connected features to track their progress and share their rides with friends. Serious cyclists can use connected features to monitor their power output, cadence, and heart rate to optimize their training. Additionally, connected e-bike drive units can receive software updates that can improve performance and fix bugs.

-

Focus on sustainability: Manufacturers are increasingly focusing on developing sustainable e-bike drive units. This includes using recycled materials in the manufacturing process and designing products that are easy to repair and recycle. For example, some manufacturers are using recycled aluminum in their motor housings. Additionally, some manufacturers are designing e-bike drive units that can be easily disassembled for repairs. This can help to extend the lifespan of e-bikes and reduce electronic waste.

-

Integration with other e-bike components: E-bike drive units are becoming more integrated with other e-bike components, such as batteries and controllers. This integration can create a more seamless and user-friendly riding experience. For example, some e-bike drive units are now integrated with batteries that can be easily removed and charged. Additionally, some e-bike drive units are integrated with controllers that can be customized to the rider’s preferences.

Production Analysis

- Meeting Demand: Manufacturers are ramping up production to meet the growing demand for e-bike drive units. This includes expanding existing facilities and building new ones.

- Geographic Distribution: Production is concentrated in Asia, particularly China, due to established manufacturing infrastructure and cost advantages. However, there’s a trend towards diversification with production facilities being set up in other regions like Europe and North America.

- Supply Chain Challenges: The market has faced supply chain disruptions due to factors like the global chip shortage and geopolitical tensions. Manufacturers are working on strategies to mitigate these risks, such as diversifying suppliers and building buffer stocks.

E-bike Drive Unit Market Pricing Analysis

Drive Unit Type:

- Mid-Drive Motors: Generally more expensive due to their complex design, higher power output, and superior performance. Ideal for e-mountain bikes and high-performance e-bikes demanding better weight distribution and a natural riding experience.

- Hub Motors: Typically more affordable due to their simpler design. They are sufficient for commuter e-bikes and cargo e-bikes where power might be less crucial than price.

Brand & Technology:

- Established brands like Bosch, Shimano, and Yamaha command a premium due to their brand recognition, reputation for reliability, and advanced technological features.

- Newer entrants or regional players might offer competitive pricing for comparable features, catering to budget-conscious consumers.

Power Output & Features:

- Drive units with higher wattage motors (offering more power for tackling hills) and advanced features like connectivity (Bluetooth, app integration) will have a higher price tag.

- Basic drive units with lower power and limited features will be more affordable.

Integration Level:

- Highly integrated drive units with seamlessly connected batteries and controllers might cost more due to the additional technology and user-friendly design.

- Less integrated systems with separate batteries and controllers might be offered at a lower price point.

By Product

- Hub Motors Dominated in 2023: Hub Motors held a significant revenue share of approximately 69.02% in 2023. These motors are favored due to their simplicity in construction, lightweight nature, and cost-effectiveness for manufacturers, making them the most prevalent motors in the e-bike market.

- Mid-Drive Motors Overview: Mid-drive motors are positioned closer to the bicycle’s center, directly connecting to gears and cranks. They offer higher torque and performance, particularly beneficial for steep hills and off-road biking. Moreover, their central position provides better handling. While they offer easy maintenance, their reliance on drivetrain components necessitates frequent replacements, increasing maintenance costs.

- Mid-Drive Motors Growth Potential: Despite concerns about higher costs and maintenance, mid-drive motors are expected to grow rapidly, projected to register a 5% growth rate in the coming years. Their advantages include improved torque, speed, and handling.

- Hub Motors Variants: Hub motors, located within the wheels’ hub, come in two variants: geared and gearless. Geared motors utilize internal gears to reduce higher RPMs, while gearless motors have a direct connection with lower RPMs. Gearless motors have zero moving parts, offering longevity, while geared motors are preferred for their lower cost.

- Challenges with Hub Motors: Hub motors, despite their minimal maintenance requirements, are heavier and offer a single gear ratio, limiting their effectiveness on hills. Their weight distribution on the wheels can also affect bicycle handling.

By Application

Leading Companies in the E-bike Drive Unit Market

- Robert Bosch GmbH

- Continental AG

- Yamaha Motor Corporation

- Panasonic

- Shimano

- MAHLE GmbH

- Giant Bicycles

- Bafang Electric (Suzhou) Co., Ltd

- Brose Fahrzeugteile SE & Co. KG

- Other

Segments Covered in the Report

By Product

- Mid-Drive Motors

- Hub Motors

By Application

- OEMs

- Aftermarket

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1160