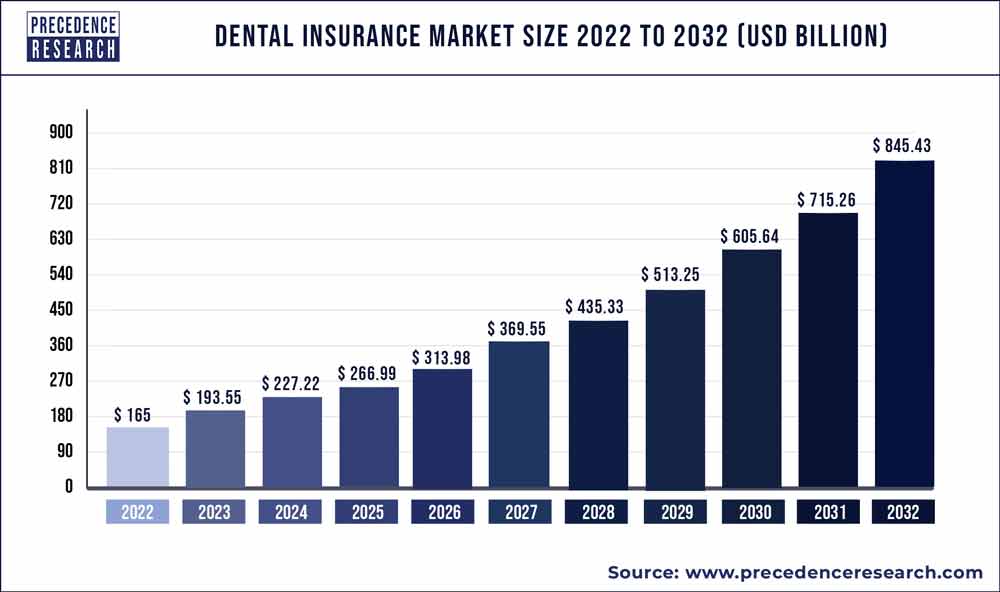

The global dental insurance market size is anticipated to reach around USD 845.43 billion by 2032 from USD 165 billion in 2022 and is poised to grow at a CAGR of 17.8% during the forecast period from 2023 to 2032. The dental insurance market is expanding due to rising awareness about oral health, increasing dental care costs, and the growing availability of dental insurance plans. Government initiatives promoting oral health coverage and the integration of dental benefits into general health insurance packages are also significant growth factors.

North America: This region dominates the global dental insurance market, driven by high healthcare expenditures and a robust insurance industry. Dental insurance is frequently bundled with health insurance plans, which enhances market penetration and sustains growth. The market here benefits from a strong focus on comprehensive coverage options and preventive dental care, supported by well-established regulatory frameworks that ensure quality standards and consumer protection.

Europe: European countries exhibit a mature dental insurance market characterized by a strong emphasis on preventive care and comprehensive coverage. Regulatory influences play a significant role in shaping market dynamics, with stringent standards ensuring high-quality service delivery and equitable access to dental insurance across different socioeconomic groups. The market is marked by innovations in insurance products tailored to meet diverse consumer needs, reflecting a growing awareness of oral health as integral to overall well-being.

Get a Sample: https://www.precedenceresearch.com/sample/1719

Asia-Pacific: This region represents a rapidly expanding market for dental insurance, driven by increasing disposable incomes and growing awareness of dental health. Governments in countries like China and India are actively promoting dental insurance as part of broader public health initiatives, aiming to improve oral health outcomes and reduce the burden of dental diseases. Market growth is also fueled by the rising adoption of insurance products among middle-class consumers and corporate sectors seeking to enhance employee benefits packages.

Latin America: The dental insurance market in Latin America shows steady growth, supported by an expanding middle class and increasing corporate adoption of insurance products. There is a rising trend towards preventive dental care and comprehensive coverage options, driven by heightened consumer awareness and improving access to dental services. Regulatory frameworks are evolving to accommodate market expansion and ensure affordability and accessibility of dental insurance products across diverse demographics.

Middle East and Africa: In this region, dental insurance penetration is relatively low compared to other regions, but there is a growing trend towards integrating dental coverage into broader health insurance packages. Market development is influenced by improving healthcare infrastructure, rising healthcare expenditures, and increasing recognition of oral health as a vital component of overall wellness. Governments and insurers are collaborating to expand access to dental insurance, particularly among underserved populations, while navigating regulatory landscapes to ensure sustainable market growth and consumer protection.

Read Report: Pathology Laboratories Market Size to Reach USD 714.70 Bn By 2032

Trends Shaping the Dental Insurance Market

Technological Advancements

Technological advancements in dentistry, such as digital imaging, tele-dentistry, and minimally invasive procedures, have significantly impacted the dental insurance market. These innovations have improved the quality of dental care, reduced treatment times, and enhanced patient experiences. As a result, dental insurance providers are increasingly incorporating these technologies into their coverage options to meet the evolving needs of their policyholders.

Increased Focus on Preventive Care

Preventive care is becoming a central focus of dental insurance plans. Insurers are emphasizing the importance of regular dental check-ups, cleanings, and preventive treatments to reduce the incidence of more serious and costly dental issues. By promoting preventive care, insurance providers can lower overall healthcare costs and improve the oral health of their insured populations.

Regulatory Changes and Compliance

The dental insurance market is heavily influenced by regulatory changes at both the national and state levels. Recent legislation aimed at improving healthcare access and affordability has led to changes in dental insurance coverage requirements and compliance standards. Insurance providers must stay abreast of these regulatory developments to ensure their plans remain compliant and competitive.

Challenges Facing the Dental Insurance Market

Rising Dental Care Costs

One of the most significant challenges facing the dental insurance market is the rising cost of dental care. Advances in dental technology and treatments, while beneficial, often come with higher price tags. This increase in costs can strain the financial viability of dental insurance plans and lead to higher premiums for policyholders.

Limited Access to Dental Care

Despite the growth of the dental insurance market, access to dental care remains limited for certain populations, particularly in rural and underserved areas. Geographic and socioeconomic barriers can prevent individuals from obtaining the dental care they need, highlighting the need for innovative solutions to improve access and affordability.

Consumer Awareness and Education

Consumer awareness and education about dental insurance options and benefits remain a challenge. Many individuals are unaware of the coverage available to them or how to navigate the complexities of dental insurance plans. Enhancing consumer education and simplifying plan information can help bridge this gap and encourage more people to take advantage of dental insurance.

Opportunities in the Dental Insurance Market

Expansion of Tele-dentistry Services

Tele-dentistry has emerged as a valuable tool for expanding access to dental care, especially in remote and underserved areas. By leveraging digital communication technologies, dental professionals can provide consultations, diagnoses, and treatment planning remotely. This expansion of tele-dentistry services presents a significant opportunity for dental insurance providers to offer innovative coverage options that meet the needs of a broader population.

Integration of Wellness Programs

Integrating wellness programs into dental insurance plans can enhance the overall value of coverage and promote better oral health outcomes. Wellness programs that include incentives for regular dental visits, healthy lifestyle choices, and preventive care can encourage policyholders to maintain good oral hygiene and reduce the risk of dental issues. Insurance providers can differentiate their plans by offering comprehensive wellness programs that address both dental and overall health.

Customized and Flexible Insurance Plans

As consumers become more discerning about their healthcare choices, the demand for customized and flexible dental insurance plans is increasing. Insurance providers have the opportunity to develop tailored plans that cater to specific needs, such as plans focused on pediatric dental care, orthodontics, or cosmetic dentistry. Offering a range of customizable options can attract a diverse customer base and enhance customer satisfaction.

Dental Insurance Market Players

- Delta Dental

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United HealthCare Services, Inc.

- Aetna Inc.

- AFLAC INCORPORATED

- Allianz

- Ameritas

- AXA

- Cigna

Market Segmentation

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Procedure

- Major

- Basic

- Preventive

By Demographics

- Senior Citizens

- Adults

- Minors

By End User

- Individuals

- Corporates

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1719