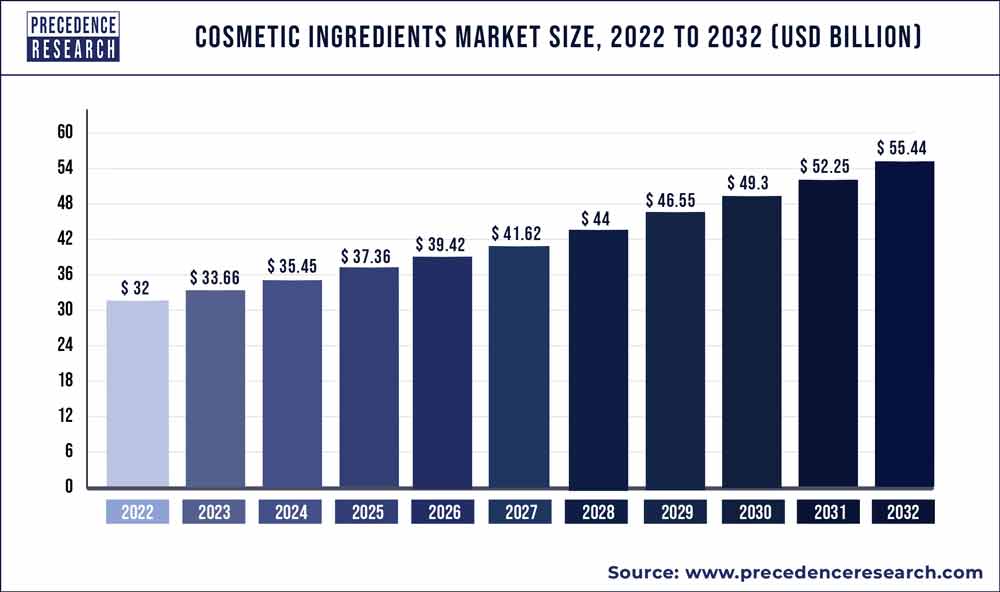

The global cosmetic ingredients market size is anticipated to reach around USD 55.44 billion by 2032 from USD 32 billion in 2022 and is poised to grow at a CAGR of 5.7% during the forecast period from 2023 to 2032. The cosmetic ingredients market is driven by increasing consumer demand for natural and organic products, advancements in technology leading to innovative ingredients, rising awareness about skincare and personal grooming, and stringent regulations promoting safer formulations. Additionally, globalization and expanding disposable incomes are fueling market growth by creating new opportunities in emerging economies.

- In 2022, the natural ingredients segment is predicted to hold the biggest market share.

- Asia-Pacific had the largest revenue share in 2022.

- From 2023 to 2032, the skin care category is predicted to have the highest market share based on end use.

- In terms of revenue share, the North American cosmetic ingredients market was significant in 2022.

Get a Sample: https://www.precedenceresearch.com/sample/2366

Cosmetic Ingredients Market Trends

Shift Towards Natural and Organic Ingredients

In recent years, there has been a notable shift in consumer preferences towards natural and organic cosmetic ingredients. This movement is driven by increasing awareness of health and environmental concerns among consumers. Natural ingredients, such as plant-derived extracts (like aloe vera, chamomile, and green tea), botanical oils (such as argan oil and jojoba oil), and eco-friendly preservatives (like tocopherol and benzyl alcohol derived from natural sources), are gaining popularity. These ingredients are perceived as safer alternatives to synthetic chemicals, promoting healthier skin and reducing environmental impact. The demand for clean beauty products free from parabens, sulfates, and artificial fragrances has surged, reflecting a broader consumer trend towards sustainable and ethical consumption.

Technological Advancements in Ingredient Development

Advancements in cosmetic science have revolutionized ingredient development, ushering in a new era of skincare innovation. Cutting-edge technologies, such as nanoencapsulation and microencapsulation, have enabled the delivery of active ingredients deep into the skin layers, enhancing their efficacy and prolonging their release. Biotechnological processes, including fermentation and enzymatic conversion, are increasingly used to produce bioactive compounds like peptides and hyaluronic acid with superior purity and bioavailability. These advancements not only improve the performance of cosmetic products but also address specific skincare concerns such as aging, hyperpigmentation, and sensitivity. Moreover, the integration of artificial intelligence (AI) and machine learning in ingredient research is accelerating the discovery of novel compounds and their potential applications in personalized skincare solutions.

Regulatory Landscape and Safety Standards

The cosmetic ingredients market operates within a complex regulatory framework aimed at ensuring product safety and efficacy. Regulatory bodies worldwide, such as the FDA (Food and Drug Administration) in the United States, the European Commission, and the National Medical Products Administration (NMPA) in China, enforce stringent guidelines for the evaluation, approval, and labeling of cosmetic ingredients. Manufacturers must conduct comprehensive safety assessments, including toxicity testing, skin sensitization studies, and stability testing, to demonstrate the safety of their products before they can be marketed to consumers. Compliance with these regulations is essential to mitigate potential health risks and uphold consumer confidence in cosmetic products. Continuous monitoring and adaptation to evolving regulatory requirements are crucial for industry stakeholders to navigate global markets and ensure compliance with regional standards.

Read Report: Anesthesia Devices Market Size to Hit USD 34.29 Billion by 2033

Cosmetic Ingredients Market Regional Analysis

North America:

- Market Dynamics: North America holds a significant share due to high consumer awareness of skincare and personal grooming. Demand is driven by trends towards natural and organic ingredients.

- Key Players: Major cosmetic ingredient suppliers and manufacturers are concentrated in the US and Canada, leveraging advanced technologies for product innovation.

- Regulatory Environment: Strict regulations by FDA influence ingredient formulation and marketing strategies.

Europe:

- Market Dynamics: Europe emphasizes sustainability and safety, influencing ingredient sourcing and manufacturing processes. Demand for eco-friendly and cruelty-free ingredients is rising.

- Key Players: European manufacturers lead in developing novel ingredients compliant with EU regulations.

- Regulatory Environment: Stringent EU regulations (e.g., REACH) govern ingredient safety and environmental impact, shaping market trends.

Asia-Pacific:

- Market Dynamics: Asia-Pacific is the fastest-growing region, driven by increasing disposable income, urbanization, and changing lifestyles. Demand for anti-aging and UV protection ingredients is high.

- Key Players: Rising domestic manufacturers in China, Japan, and South Korea focus on technological advancements and traditional herbal ingredients.

- Regulatory Environment: Diverse regulatory frameworks across countries influence market entry strategies and product formulations.

Latin America:

- Market Dynamics: Latin America exhibits growing demand for cosmetic ingredients, driven by expanding middle-class populations and increasing beauty consciousness.

- Key Players: Brazil leads in production of natural ingredients like Amazonian extracts. Local companies focus on sustainability and biodiversity.

- Regulatory Environment: Regulatory harmonization efforts aim to streamline ingredient approvals and promote regional trade.

Middle East & Africa:

- Market Dynamics: The region shows promising growth driven by rising disposable incomes and a burgeoning beauty industry. Demand for halal-certified and dermatologically tested ingredients is increasing.

- Key Players: Local and international companies invest in product customization to cater to diverse consumer preferences.

- Regulatory Environment: Regulatory frameworks are evolving to align with global standards while addressing local cultural and religious sensitivities.

Cosmetic Ingredients Market Dynamics

Drivers:

Increasing Demand for Natural Ingredients:

- Consumers are increasingly concerned about the ingredients used in their skincare and cosmetic products. There’s a growing preference for natural and organic ingredients perceived to be safer and more sustainable.

- This trend is driven by rising awareness of environmental issues and health concerns related to synthetic chemicals commonly found in cosmetics.

Innovation in Product Development:

- Cosmetic ingredient manufacturers are continuously innovating to address evolving consumer preferences and needs. For example, there’s a strong demand for ingredients that provide anti-aging benefits, UV protection, and enhanced skin hydration.

- Advances in biotechnology and extraction techniques allow for the development of novel ingredients that offer improved efficacy and safety profiles.

Growing Disposable Income:

- Emerging economies are experiencing significant growth in disposable incomes, leading to higher consumer spending on personal care products.

- Consumers in these markets are increasingly willing to invest in premium cosmetic products, including those formulated with high-quality and innovative ingredients.

Restraints:

Stringent Regulations:

- The cosmetic industry is subject to strict regulatory frameworks concerning ingredient safety, labeling, and environmental impact.

- Compliance with these regulations requires substantial resources and can delay product launches, impacting market agility and innovation.

High Cost of Research and Development:

- Developing new cosmetic ingredients involves extensive research, testing, and validation processes to ensure safety and efficacy.

- The high costs associated with R&D can be prohibitive for smaller companies, limiting their ability to innovate and compete effectively in the market.

Limited Shelf Life:

- Many cosmetic ingredients, especially natural and active ingredients, have a limited shelf life and require careful handling and storage.

- This limitation adds complexity to supply chain management and can lead to product wastage if not managed effectively, affecting profitability.

Opportunities:

Expansion in Emerging Markets:

- Emerging markets such as Asia-Pacific, Latin America, and Africa present substantial growth opportunities due to rising consumer awareness and increasing urbanization.

- These regions offer large, untapped consumer bases eager for affordable yet high-quality cosmetic products.

Rising Demand for Anti-Pollution Products:

- Urbanization and environmental pollution have heightened consumer concerns about the effects of pollution on skin health.

- There’s a growing demand for cosmetic ingredients that provide protection against environmental stressors, such as pollutants and UV radiation, creating opportunities for innovative formulations.

Growth of E-commerce:

- The rapid expansion of e-commerce platforms has revolutionized the distribution of cosmetic products, enabling direct-to-consumer sales and global reach.

- Cosmetic ingredient manufacturers can leverage online channels to promote their products, reach a wider audience, and gather valuable consumer feedback for product development.

Regulatory Landscape and Safety Standards

The cosmetic ingredients industry operates under strict regulatory frameworks designed to uphold product safety and safeguard consumer interests. Major regulatory bodies such as the FDA in the United States and the EU Cosmetics Regulation in Europe play pivotal roles in establishing and enforcing standards. These regulations encompass comprehensive guidelines covering ingredient safety assessments, mandatory labeling requirements, and the substantiation of product claims.

In the United States, the FDA oversees cosmetic products under the Federal Food, Drug, and Cosmetic Act (FD&C Act), which mandates that cosmetics must not be adulterated or misbranded. This includes ensuring that ingredients used are safe for their intended use and accurately labeled. The FDA monitors compliance through inspections, enforcement actions, and collaboration with industry stakeholders.

Similarly, the EU Cosmetics Regulation sets stringent standards across all member states of the European Union. It mandates safety assessments of cosmetic ingredients, requiring manufacturers to submit safety dossiers for new substances and adhere to strict labeling rules. The regulation also prohibits the use of certain substances known to pose health risks, ensuring consumer protection across the EU market.

These regulatory frameworks are crucial in maintaining consumer confidence in cosmetic products, fostering innovation while prioritizing safety and transparency. Compliance with these standards not only assures consumers of product safety but also facilitates market access and international trade for cosmetic manufacturers.

Cosmetic Ingredients Market Companies

- Clariant AG

- Solvay S.A.

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Croda International PLC

- Estee Lauder Company

- Ashland Global Specialty Chemicals

- Lonza Group Ltd.

- Wacker Chemie AG

Segments Covered in the Report

By Ingredient Type

- Synthetic

- Natural

By Product Type

- Surfactant

- Emollient

- Polymer

- Oleo-chemical

- Botanical Extract

- Rheology Modifier

- Preservatives

- Antioxidant

- Emulsifier & Stabilizer

- Others

By Functionality

- Cleansing Agents & Foamers

- Aroma

- Moisturizing

- Specialty

- Others

By End Use

- Skin Care

- Oral Care

- Hair Care

- Body Care

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2366