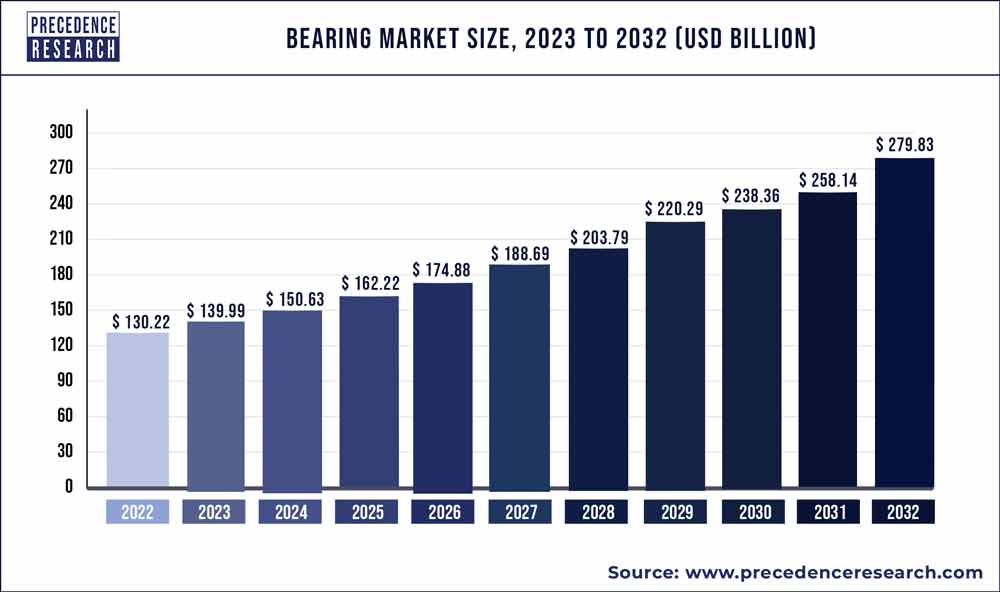

The global bearing market size was estimated at USD 133.99 billion in 2023 and is projected to hit around USD 279.83 billion by 2032, growing at a CAGR of 8% from 2023 to 2032.

Bearing Market Regional Stance

In 2022, the Asia-Pacific region emerged as a significant player in the global bearings market, contributing to over 40% of the revenue share. This dominance is primarily fueled by economic powerhouses like China and Japan, which are at the forefront of driving market growth. The region’s booming machinery and automobile manufacturing sectors, coupled with a robust aftermarket for industrial equipment and automobile repair, are key factors propelling the surge in sales. As these industries continue to expand rapidly, the demand for bearings is expected to witness a notable uptick in the coming years.

Europe, too, is poised for favorable growth in the bearings market. Supported by sustainable economic growth and increased investment, the region is experiencing a boost in the sales and production of electric and hybrid vehicles. Moreover, the ongoing development and innovation within the automotive industry are driving the demand for bearings across Europe.

Meanwhile, North America is gearing up for long-term market growth, primarily driven by the region’s escalating car production. With SUV and hatchback sales on the rise, the demand for bearings is expected to follow suit. Notably, hatchbacks typically require an average of 60 bearings, while sedans and SUVs incorporate even more. Additionally, there’s a growing emphasis on lightweight vehicle components among Original Equipment Manufacturers (OEMs), leading to a constant pursuit of lighter bearing solutions to mitigate the overall weight of vehicles.

Bearing Market Dynamics

Driver