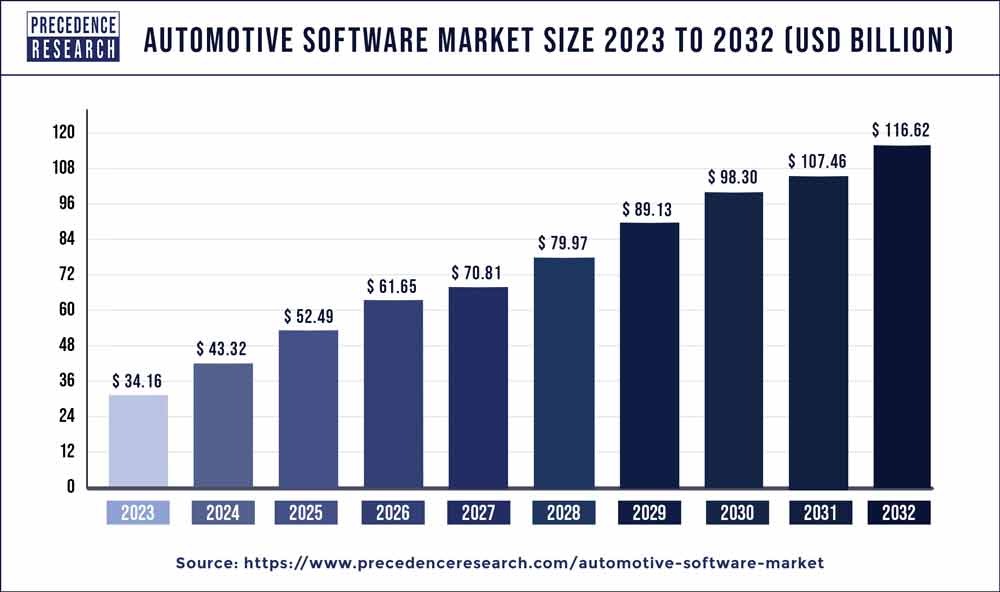

The global automotive software market size surpassed USD 34.16 billion in 2023 and is expected to hit around USD 116.62 billion by 2032, poised to grow at a CAGR of 14.6% from 2024 to 2032. The growth of the automotive software market is driven by increasing demand for connected vehicles, advancements in autonomous driving technology, and the rising adoption of electric vehicles. These factors are reshaping the industry by enhancing vehicle performance, safety, and user experience through sophisticated software solutions.

Key Highlights

- The application software sector held a market share of around 51.7% in 2023.

- By vehicle type, the passenger car category had a revenue share of 54.83% in 2023.

- By application, autonomous driving accounted for 13.4% of revenue in 2023.

- By region, the Asia Pacific region has a revenue share of around 37.2% in 2023.

- The North American region is expected to increase at a CAGR of 17.2% during the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/2048

Automotive Software Market Regional Analysis

North America: Known for its strong automotive industry, North America leads in the adoption of advanced driver assistance systems (ADAS) and connected vehicle technologies. The presence of major automotive manufacturers and tech companies fosters a competitive landscape for software solutions. Regulatory frameworks like the US NHTSA’s guidelines influence software development towards safety and compliance.

Europe: Europe emphasizes both safety and environmental regulations, shaping automotive software towards stringent standards such as Euro NCAP safety ratings and emissions controls. The region is also advancing in autonomous driving technologies, with major automakers and tech firms collaborating on research and development.

Asia-Pacific: This region, particularly China, Japan, and South Korea, is a hub for automotive manufacturing and technological innovation. Rapid urbanization and increasing disposable income drive demand for connected vehicles and electric mobility solutions. Government policies promoting electric vehicles (EVs) and smart infrastructure further accelerate software integration in vehicles.

Latin America: The automotive software market in Latin America is evolving with the growing adoption of digital platforms and IoT technologies. Economic factors, regulatory challenges, and infrastructure development influence the pace of software integration, particularly in larger markets like Brazil and Mexico.

Middle East and Africa: Emerging markets in this region are gradually integrating automotive software solutions, focusing on connectivity and fleet management systems. Infrastructure development, urbanization trends, and regulatory frameworks play pivotal roles in shaping market dynamics.

Read Report: On Board Charger Market Size to Hit USD 20.49 Billion by 2033

Automotive Software Market Trends

- Software Over-the-Air (OTA) Updates: OTA update capabilities represent a paradigm shift in how automotive software is managed and updated. Unlike traditional methods that require physical visits to service centers, OTA updates allow manufacturers to remotely deploy software patches, upgrades, and new features to vehicles over the air. This capability enhances vehicle reliability, addresses software bugs promptly, and improves user satisfaction by ensuring vehicles are always equipped with the latest software enhancements. OTA updates also enable manufacturers to adapt quickly to regulatory changes and customer feedback, fostering continuous improvement and innovation in automotive software development.

- User Experience (UX): Automotive software is pivotal in shaping the user experience by integrating intuitive interfaces, personalized settings, and advanced functionalities. Modern vehicles utilize software to incorporate voice recognition, gesture control, and AI-powered virtual assistants, making interactions more natural and responsive for drivers and passengers. UX-focused software design aims to simplify complex tasks such as navigation, entertainment selection, and climate control, enhancing convenience and satisfaction during journeys. By prioritizing user-centric design principles, automotive manufacturers are creating seamless and enjoyable driving experiences that cater to diverse consumer preferences and expectations.

- Digital Twins: Digital twin technology is revolutionizing automotive design, manufacturing, and maintenance processes by creating virtual replicas of physical vehicles and systems. Software simulations enable engineers to optimize vehicle performance, predict maintenance needs, and streamline production workflows with greater accuracy and efficiency. Digital twins facilitate rapid prototyping and testing of new vehicle designs, allowing manufacturers to iterate and refine concepts before physical production begins. By leveraging real-time data and simulation capabilities, automotive companies can enhance product reliability, reduce development costs, and accelerate time-to-market for innovative vehicle technologies.

Automotive Software Market Dynamics

Drivers:

- Advancements in Autonomous Driving Technology: The development of autonomous and semi-autonomous driving features is propelling the demand for sophisticated software solutions. These technologies require intricate algorithms for perception, decision-making, and control, driving innovation in automotive software.

- Increasing Consumer Demand for Connected Cars: Consumers increasingly expect seamless connectivity in their vehicles, including features like infotainment, navigation, and remote diagnostics. This demand is fueling growth in automotive software that enables these functionalities and enhances user experience.

- Regulatory Requirements for Safety and Emissions: Stringent global regulations are pushing automakers to integrate software solutions that enhance vehicle safety, reduce emissions, and comply with environmental standards. This regulatory drive stimulates innovation and adoption of new automotive software technologies.

Restraints:

- High Costs of Software Development and Integration: Developing and integrating advanced software into vehicles can incur substantial costs. This includes expenses for research, development, testing, and certification processes, posing financial challenges for automakers.

- Cybersecurity Concerns: Connected vehicles are vulnerable to cybersecurity threats such as hacking and data breaches. Ensuring robust cybersecurity measures in automotive software is critical but adds complexity and cost to development efforts.

- Regulatory Hurdles: Meeting varying regulatory requirements across different regions adds complexity and time to market for automotive software. Compliance often demands significant resources and can delay product launches.

Opportunities:

- Expansion of AI and Machine Learning: AI and machine learning technologies are increasingly being applied in automotive software for tasks such as predictive maintenance, intelligent navigation, and personalized driving experiences. This trend opens up new opportunities for innovation and product differentiation.

- Growth in Electric and Hybrid Vehicles: The increasing adoption of electric and hybrid vehicles creates demand for specialized software solutions. These solutions are crucial for managing battery performance, optimizing energy efficiency, and integrating with charging infrastructure.

- Partnerships with Tech Companies: Collaborations between automakers and tech companies are accelerating innovation in automotive software. Such partnerships foster the development of cutting-edge technologies like advanced driver assistance systems (ADAS) and smart mobility solutions.

Regulatory Landscape

Regulations play a crucial role in shaping automotive software development and deployment. Standards such as ISO 26262 for functional safety and GDPR for data protection impose compliance requirements on manufacturers, influencing software design and implementation strategies globally.

Automotive Software Market Leading Companies

- ATEGO SYSTEMS INC. (PTC)

- AUTONET MOBILE, INC.

- ADOBE

- AIRBIQUITY INC

- BLACKBERRY LIMITED

- GOOGLE (ALPHABET INC.)

- MONTAVISTA SOFTWARE, LLC

- GREEN HILLS SOFTWARE

- MICROSOFT CORPORATION

- WIND RIVER SYSTEMS, INC

Segments covered in the report

By Application

- ADAS & Safety Systems

- Body Control & Comfort System

- Powertrain System

- Infotainment System

- Communication System

- Vehicle Management & Telematics

- Connected Services

- Autonomous Driving

- HMI Application

- Biometrics

- Remote Monitoring

- V2X System

By Vehicle Type

- Passenger car

- LCV

- HCV

By Software Layer

- Operating System

- Middleware

- Application software

By EV Application

- Charging Management

- Battery Management

- V2G

By Offering

- Solutions

- Services

By Organization Size

- Large Scale Organizations

- Medium Scale Organization

- Small Scale Organization

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2048