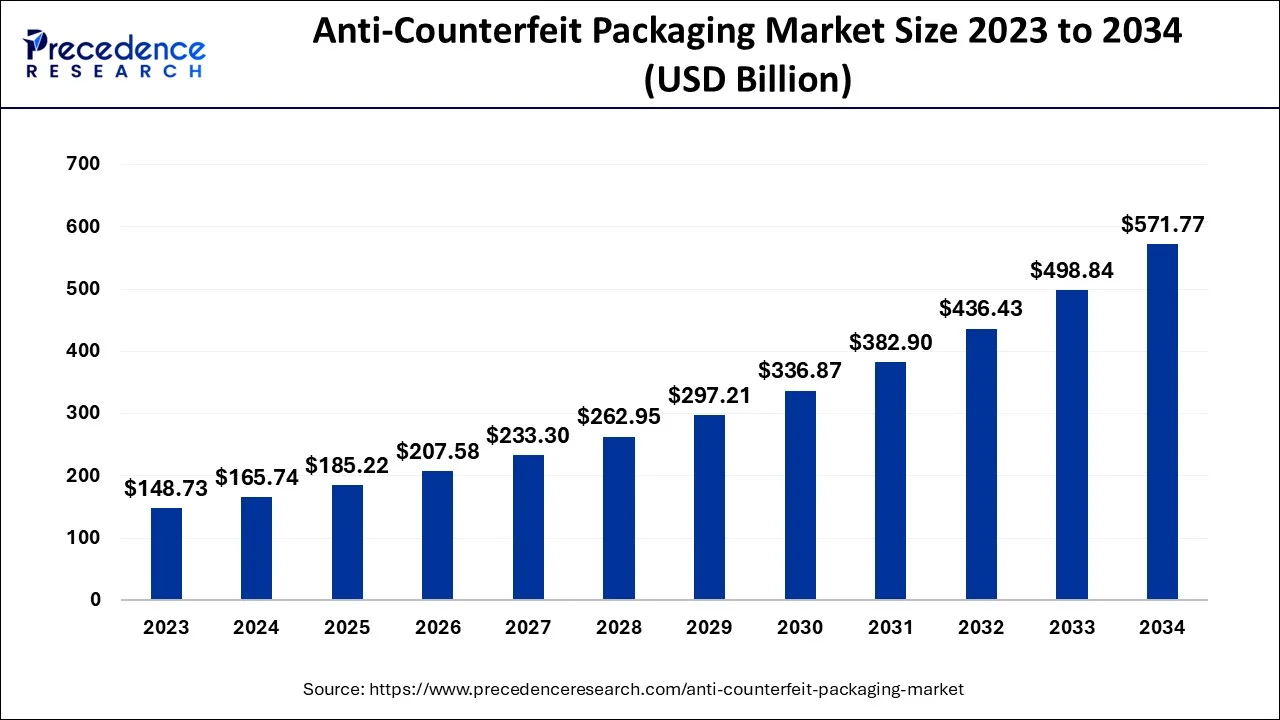

The global anti-counterfeit packaging market size surpassed USD 148.73 billion in 2023 and is expected to hit around USD 484.97 billion by 2033, poised to grow at a CAGR of 12.54% from 2024 to 2033.

Anti-Counterfeit Packaging Market Key Pointers

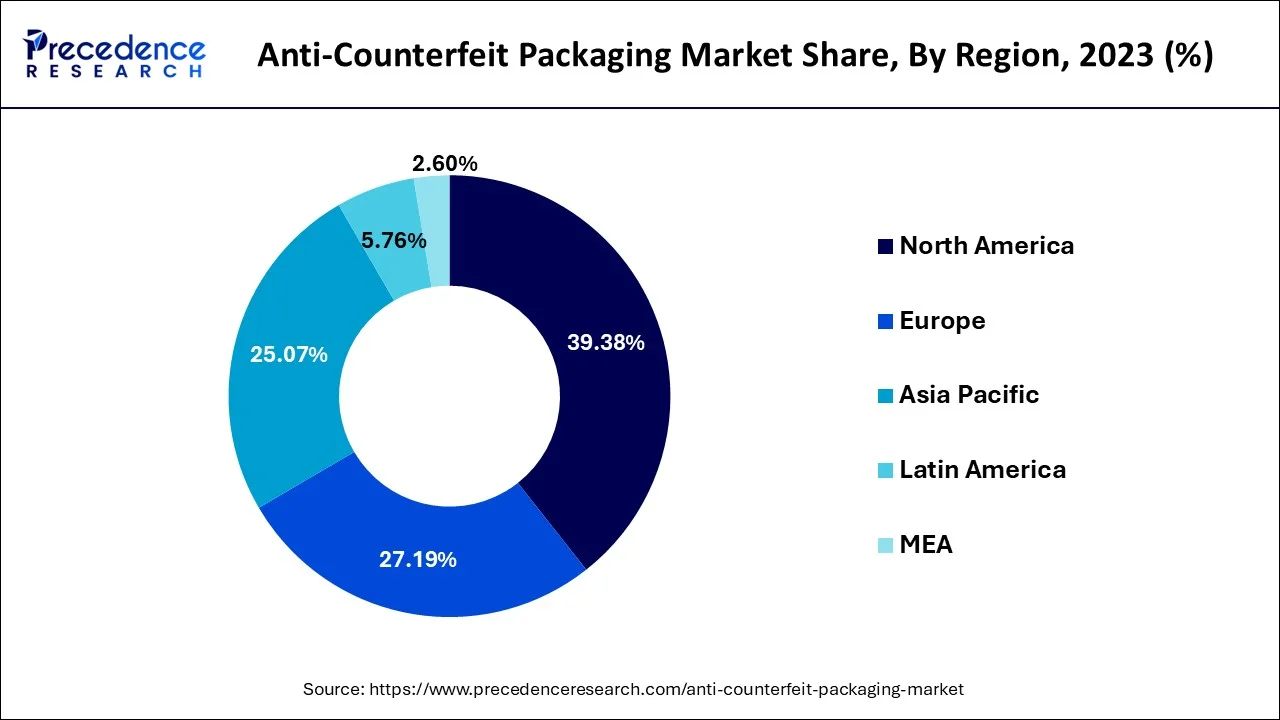

- North America is predicted to grow at a CAGR of 12.4% and account for more than 39.38% of market share in 2023.

- With a 28.94% revenue share, the mass encoding category led the market in 2023 in terms of type.

- In 2023, the pharmaceuticals segment held the greatest market share, accounting for 24.3% of all end users.

- In 2023, the bottle and jar category accounted for 17.9% of the total sales share by packaging format.

Get a Sample: https://www.precedenceresearch.com/sample/2701

Anti-Counterfeit Packaging Market Regional Insights

- North America: The United States holds a prominent position in the global anti-counterfeit packaging market, with stringent government measures and consumer demand driving market growth.

- Europe: With a focus on product traceability and regulatory compliance, Europe has emerged as a significant market for anti-counterfeit packaging solutions.

- Asia-Pacific: Rapid industrialization, coupled with stringent health and safety regulations, has propelled the demand for anti-counterfeit packaging in the Asia-Pacific region, particularly in countries like China and India.

Anti-Counterfeit Packaging Market Dynamics

Drivers:

- Increasing Counterfeiting Concerns: The rising prevalence of counterfeit products across various industries, including pharmaceuticals, food and beverage, electronics, and luxury goods, drives the demand for anti-counterfeit packaging solutions.

- Stringent Regulations: Government regulations mandating the use of anti-counterfeit measures, such as serialization, tamper-evident features, and track-and-trace systems, propel the adoption of anti-counterfeit packaging solutions to ensure compliance and consumer safety.

- Brand Protection: Brand owners’ growing emphasis on protecting their intellectual property, maintaining brand reputation, and safeguarding consumers from counterfeit products fuels the demand for advanced anti-counterfeit packaging technologies and authentication solutions.

- Technological Advancements: Continuous innovations in printing technologies, security features, and track-and-trace systems enhance the effectiveness and sophistication of anti-counterfeit packaging solutions, driving market growth.

Restraints:

- Cost Constraints: The implementation of anti-counterfeit packaging solutions often involves additional costs for materials, technologies, and implementation processes, which may deter adoption, particularly among small and medium-sized enterprises (SMEs) with limited budgets.

- Complexity and Integration Challenges: Integrating anti-counterfeit features into existing packaging formats or supply chain systems can be complex and time-consuming, posing challenges for manufacturers, packagers, and supply chain partners.

- Technological Limitations: Despite advancements, certain anti-counterfeit technologies may still face limitations in terms of scalability, reliability, and compatibility with different packaging materials and production processes, limiting their widespread adoption.

- Consumer Awareness: Limited awareness among consumers about the risks associated with counterfeit products and the importance of anti-counterfeit packaging solutions may hinder market growth and adoption rates.

Opportunities:

- Emerging Markets: The expanding markets in developing regions, coupled with increasing disposable incomes and urbanization, offer opportunities for anti-counterfeit packaging providers to address growing concerns about counterfeit products and tap into new customer segments.

- Collaborative Initiatives: Partnerships between governments, industry stakeholders, and technology providers to combat counterfeiting through coordinated efforts, information sharing, and capacity building present opportunities for collaborative innovation and market growth.

- Integration with Supply Chain Technologies: Integration of anti-counterfeit packaging solutions with emerging technologies such as blockchain, IoT (Internet of Things), and AI (Artificial Intelligence) enables enhanced traceability, authentication, and supply chain transparency, driving adoption across industries.

- Customization and Differentiation: Customizable anti-counterfeit packaging solutions that offer brand-specific authentication features, personalized engagement experiences, and value-added services create opportunities for differentiation and premiumization in the market.

Technology Insights

The anti-counterfeit packaging market is characterized by a rich tapestry of cutting-edge technologies aimed at thwarting counterfeit activities. These technologies serve as the bedrock of anti-counterfeit measures, offering diverse solutions to authenticate products and ensure supply chain integrity.

- Holograms: Holographic technology provides visually striking authentication features that are challenging to replicate, offering a visual cue for consumers to verify product authenticity.

- RFID (Radio Frequency Identification): RFID tags enable seamless product tracking and authentication throughout the supply chain, empowering companies to monitor inventory movement and detect unauthorized tampering.

- Mass Encoding: Mass encoding solutions assign unique identifiers such as barcodes, QR codes, or serial numbers to individual products, facilitating robust product authentication and supply chain transparency on a large scale.

- Forensic Markers: Forensic markers employ covert security features such as invisible inks or microscopic identifiers, enabling sophisticated authentication and counterfeit detection measures.

- Tamper Evidence: Tamper-evident seals and features provide visible indicators of product tampering, ensuring consumer confidence and product integrity.

End-User Analysis

Pharmaceuticals

The pharmaceutical industry stands as a cornerstone of the anti-counterfeit packaging market, driven by the imperative to safeguard public health and combat the proliferation of counterfeit medications. Given the grave consequences of counterfeit pharmaceuticals, pharmaceutical companies invest significantly in anti-counterfeit packaging solutions to ensure the integrity of their products and protect consumer well-being.

Food and Beverage

In the food and beverage sector, consumer safety reigns supreme, prompting an increasing adoption of anti-counterfeit packaging solutions. With consumers demanding transparency and authenticity in their food products, manufacturers leverage anti-counterfeit measures to safeguard against adulteration and ensure the traceability of ingredients from farm to fork.

By Packaging Format

Jars and bottles emerge as stalwarts in the realm of anti-counterfeit packaging, owing to their ubiquitous presence across diverse industries. These packaging formats offer ample opportunities for the integration of advanced security features such as invisible inks, tamper-evident seals, and unique identifiers, bolstering the efficacy of anti-counterfeit measures. By fortifying jars and bottles with robust authentication technologies, companies mitigate the risks posed by counterfeit activities and uphold product integrity.

In essence, the convergence of advanced technologies, stringent end-user demands, and innovative packaging formats propels the anti-counterfeit packaging market towards a future defined by heightened security, transparency, and consumer trust.

Anti-Counterfeit Packaging Market Key Industry Developments

- Avery Dennison Corporation: Acquisition of Vestcom expands branded labeling options, bolstering the company’s presence in the retail and consumer packaged goods sectors.

- SICPA Holdings: Introduction of integrated product security labels enhances counterfeit resistance and traceability, safeguarding brand reputation.

- CCL Industries Inc.: Acquisition of Flexpol sp. z. o. o. strengthens the company’s capacity to support the label sector in Europe, fostering innovation and market growth.

Anti-counterfeit Packaging Market Leading Companies:

- Avery Dennison Corporation

- CCL Industries Inc.

- Mettler Toledo International Inc.

- SICPA SA

- 3M Company

- Hologram Industries

- Tesa SE

- HID Global Corporation

- DigiSeal Inc.

- Brandprotect GmbH

Segments Covered in the Report:

By Technology

- Holograms

- RFID

- Mass Encoding

- Forensic Markers

- Tamper Evidence

- Others

By Packaging Format

- Bottles & Jars

- Vials & Ampoules

- Blisters

- Trays

- Pouches & Sachets

- Tubes

- Syringes

By End-User

- Pharmaceuticals

- Food and Beverage

- Automotive

- Personal Care

- Electrical & Electronics

- Luxury Products

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2701