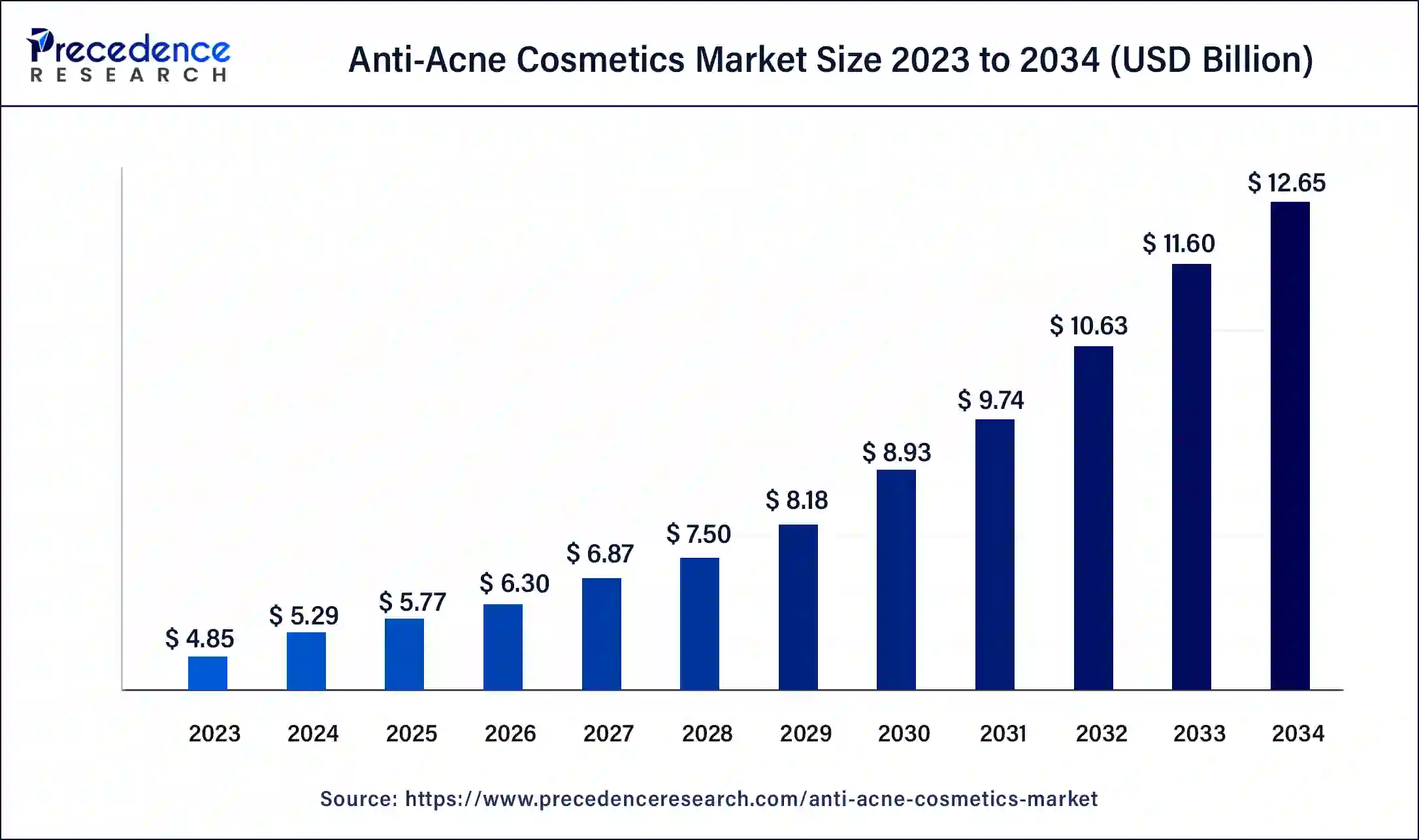

Anti-Acne Cosmetics Market Size and Growth Rate

The global anti-acne cosmetics market size was valued at USD 4.85 billion in 2023, the market is projected to reach USD 12.65 billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.11% from 2024 to 2034. Increasing pollution, dietary changes, and lifestyle shifts, along with a rise in endocrine disorders, are boosting the demand for anti-acne products. Additionally, the trend towards investing in upscale skin care, coupled with higher smartphone and internet penetration in emerging economies, is expanding access to global e-commerce and retail platforms. Advances in skin pharmacology and new acne treatments further stimulate market demand. The reduction of social stigma surrounding skincare and makeup, especially in emerging markets, and the rising disposable income among the middle class in regions like Asia Pacific are driving the market. Moreover, growing consumer preference for organic alternatives presents a substantial opportunity for market expansion.

Market Overview

The Anti-acne cosmetics market has been growing steadily due to the increasing prevalence of acne across all age groups, especially among teenagers and young adults. The rise in awareness regarding skin health, appearance, and the harmful effects of untreated acne is driving the demand for effective anti-acne solutions.

Get a Sample: https://www.precedenceresearch.com/sample/4881

1. Rising Demand for Natural and Organic Products

- Consumer Preference: There’s a growing preference for natural, organic, and clean beauty products. Consumers are increasingly aware of the ingredients used in skincare and prefer products free from harsh chemicals, parabens, and sulfates.

- Product Offerings: Brands are expanding their portfolios to include products with ingredients like tea tree oil, aloe vera, witch hazel, and salicylic acid derived from natural sources.

2. Technological Advancements

- Formulation Innovation: Companies are investing in research and development to create more effective anti-acne formulations. This includes the use of nanotechnology for better delivery of active ingredients and the development of products that target acne at a molecular level.

- Personalization: With the rise of AI and big data, brands are offering personalized skincare solutions. Products are now being tailored to individual skin types and concerns, enhancing their effectiveness.

3. Increase in Male Grooming

- Expanding Market: The anti-acne cosmetics market is no longer limited to women. There’s a significant rise in demand from male consumers, leading to the development of gender-neutral and male-specific skincare products.

- Marketing Strategies: Brands are increasingly targeting men through marketing campaigns and product lines that cater specifically to male skincare needs.

4. Rise of E-commerce and Direct-to-Consumer Brands

- Online Sales Growth: The convenience of online shopping has fueled the growth of the anti-acne cosmetics market. E-commerce platforms and direct-to-consumer (DTC) brands are seeing significant sales increases, especially among younger demographics.

- Subscription Models: Some brands are adopting subscription models, offering regular deliveries of anti-acne products, which ensures consistent usage and customer retention.

5. Sustainability and Ethical Practices

- Eco-friendly Packaging: Consumers are increasingly concerned about the environmental impact of their purchases. Brands are responding by adopting sustainable packaging solutions, such as recyclable or biodegradable materials.

- Cruelty-Free and Vegan Products: There’s a growing demand for cruelty-free and vegan products. Many brands are now emphasizing these aspects in their product offerings and marketing campaigns.

6. Focus on Holistic Skincare

- Multi-functional Products: Consumers are looking for products that not only treat acne but also offer additional skincare benefits, such as hydration, anti-aging, and skin brightening. This has led to the rise of multi-functional skincare products.

- Holistic Approach: There is a trend towards a holistic approach to skincare, where products are designed to not only treat symptoms but also improve overall skin health.

7. Influence of Social Media and Influencers

- Product Awareness: Social media platforms like Instagram, TikTok, and YouTube play a crucial role in shaping consumer preferences. Influencers and skincare experts regularly review and recommend anti-acne products, significantly impacting purchasing decisions.

- User-Generated Content: Brands are leveraging user-generated content and testimonials to build trust and authenticity with their audience.

Read Report: eVTOL Aircraft Market Size to Worth USD 35.79 Bn by 2032

Anti-Acne Cosmetics Market Companies: Production, Demand, Import/Export Trade, and Pricing

| Company | Production & Demand | Import/Export & Trade | Pricing |

|---|---|---|---|

| Clinique Laboratories, LLC | High demand in North America and Europe; dermatologist-developed skincare products. | Strong export presence, particularly in Asia. | Premium range. |

| Ancalima Lifesciences Ltd. | Focus on affordable anti-acne solutions; demand in developing markets. | Exports to Southeast Asia and Africa. | Budget-friendly. |

| Guthy-Renker | Proactive anti-acne products; high demand in North America. | Imports high-quality ingredients; exports within North America. | Mid to premium range. |

| Murad, Inc. | Clinical-strength products; popular among professionals and salons. | Active in North America, Europe, expanding in Asia. | Premium pricing. |

| L’Oréal S.A. | Global leader with a wide range catering to different skin types. | Extensive global trade network with significant exports. | Wide range: affordable to luxury. |

| The Mentholatum Company | Known for medicated skincare; strong in Asia-Pacific and North America. | Significant import/export within Asia and North America. | Affordable to mid-range. |

| Kosé Corporation | High demand in Japan and China; focuses on quality skincare. | Exports mainly within Asia. | Mid to high-end. |

| Johnson & Johnson | Extensive global manufacturing with broad anti-acne product range. | Major export markets include North America, Europe, and Asia. | Affordable to mid-range. |

| LVMH SE | Focus on luxury skincare, including anti-acne products. | Limited exports, mainly high-value markets in Europe and North America. | High-end. |

| Beiersdorf AG | Known for NIVEA; significant demand in Europe. | Active import/export activities in Europe and Asia. | Mid-range. |

| KOSE Corporation | Japanese premium skincare with high demand in Asia. | Export-heavy, focusing on Asia. | Premium products. |

| Rohto Pharmaceutical Co. | Medicated skincare focus; strong in Japan and Southeast Asia. | Exporting mainly to Asia and North America. | Affordable to mid-range. |

| Cetaphil | Gentle, dermatologically approved products; global demand. | Strong export presence in Europe and North America. | Mid-range. |

| La Roche-Posay | Dermatologist-recommended; strong in Europe and North America. | Extensive export network with a focus on clinical effectiveness. | Premium. |

| Estée Lauder Companies | Global production with high demand for luxury skincare. | Active in premium export markets. | High-end. |

| Sephora USA, Inc. | Offers a variety of in-house and third-party brands; strong in North America. | Imports a wide range of international products. | Range from affordable to luxury. |

| Dermalogica | Professional-grade products popular in salons and clinics. | Active export markets include Europe, North America, and Asia. | Premium. |

| Unilever PLC | Mass-market focus with global manufacturing capabilities. | Extensive import/export network worldwide. | Affordable to mid-range. |

Anti-Acne Cosmetics Market by Product

- Creams & Lotions Segment: This segment dominated the anti-acne cosmetics market in 2023, driven by the demand for products that hydrate, soothe inflamed skin, and reduce excess oil. Creams and lotions are preferred due to their over-the-counter availability compared to oral medications. Consumers favor lightweight, non-greasy formulations that act as humectants and provide skin hydration. Medicated options also offer protection against other skin conditions like psoriasis and eczema.

- Others Segment Growth: The segment including face cleansers, gels, serums, and essential oils is expected to grow the fastest in the forecast period. These products offer tailored formulations for various skin types, better absorption, unclogging of pores, and regulation of sebum production, reducing acne formation.

Anti-Acne Cosmetics Market by Gender

- Women Segment: Women led the global anti-acne cosmetics market in 2023, driven by a strong focus on aesthetics, the high frequency of skin disorders, and the use of cosmetic products, which can contribute to acne. Hormonal fluctuations, especially around menstrual cycles, contribute to higher acne prevalence among women compared to men after adolescence. These factors make the female consumer base the fastest-growing segment in the market.

Anti-Acne Cosmetics Market by Formulation

- Inorganic Formulations: Inorganic products held the largest market share in 2023 due to their established presence and consumer familiarity.

- Organic Formulations Growth: The organic segment is set to expand rapidly as consumers shift away from products containing artificial fragrances, sulfates, parabens, phthalates, petrochemicals, and synthetics, favoring natural ingredients for treating acne.

Regional Analysis of the Anti-Acne Cosmetics Market

Asia Pacific

- Market Size: The Asia Pacific anti-acne cosmetics market was valued at USD 2.04 billion in 2023.

- Projected Growth: The market is expected to reach approximately USD 5.38 billion by 2034, growing at a CAGR of 9.21% from 2024 to 2034.

- Market Share: Asia Pacific held the largest share of the anti-acne cosmetics market in 2023.

- Key Drivers: The rapid growth in this region is driven by increasing skincare awareness, a large youth population, and high demand for anti-acne products. Additionally, Asia Pacific serves as a significant export market for U.S. and European brands, contributing to its robust growth.

Europe

- Market Outlook: Europe is anticipated to be the fastest-growing anti-acne cosmetics market in the coming years.

- Key Countries: France and Germany are leading the growth within Europe.

- Growth Factors: The rising demand for advanced and premium skincare solutions, increasing awareness about acne prevention, and a growing inclination towards organic and natural products are driving the market’s expansion in Europe.

North America

- Market Trends: North America, including the U.S., has a well-established anti-acne cosmetics market. The region is characterized by a high demand for innovative and high-quality skincare products.

- Key Factors: The presence of major global brands, increasing consumer focus on skincare, and advanced distribution channels contribute to the market’s stability and growth.

Latin America and Middle East & Africa

- Market Dynamics: Both regions are likely to have smaller market sizes compared to Asia Pacific and Europe. However, there is growing interest in anti-acne products due to increasing urbanization and rising skincare awareness.

- Opportunities: Emerging markets in these regions present opportunities for growth, especially with the introduction of affordable and effective anti-acne solutions tailored to local preferences.

Segments Covered in the Report

By Product

- Mask

- Creams & Lotions

- Cleansers & Toners

- Others

By Gender

- Women

- Men

By Formulation

- Inorganic

- Organic

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4881