Aerial Work Platforms Market Size and Growth Factors

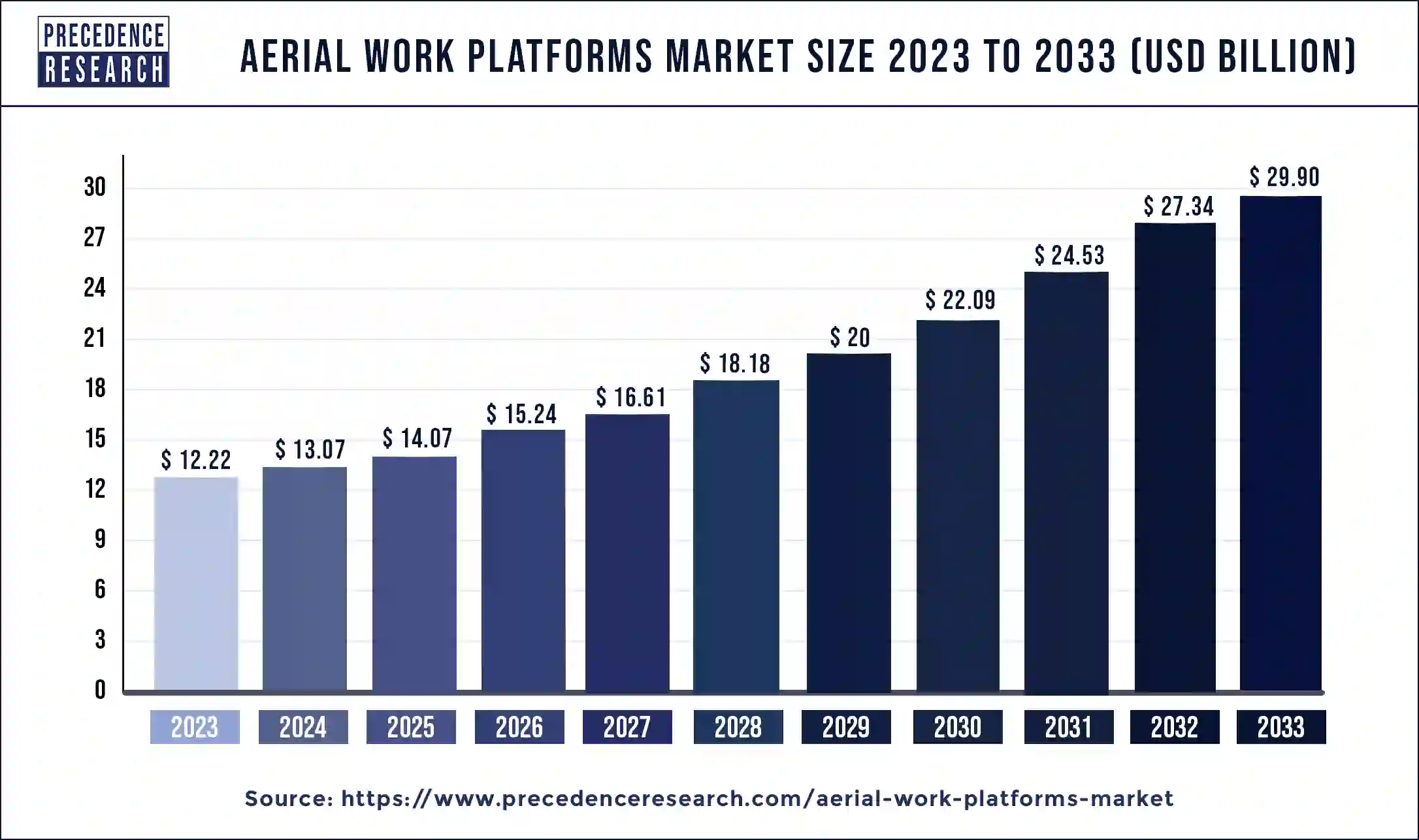

The global aerial work platforms market size reached USD 12.22 billion in 2023 and is projected to hit around USD 29.90 billion by 2033, expanding at a CAGR of 9.3% from 2024 to 2033.

Aerial Work Platforms Market Key Pointers

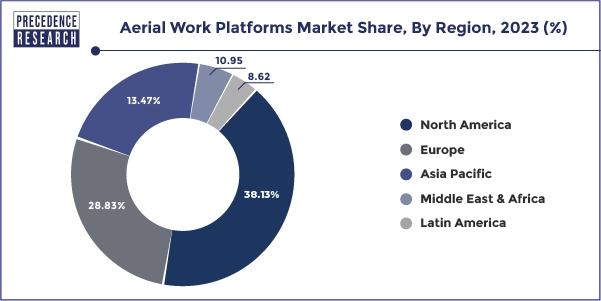

- As of 2023, North America had the greatest market share of 38.13%.

- Over the course of the projected period, Asia Pacific is anticipated to grow at the fastest CAGR.

- Construction was the market leader by end-user, with the largest market share of 45.53% in 2023.

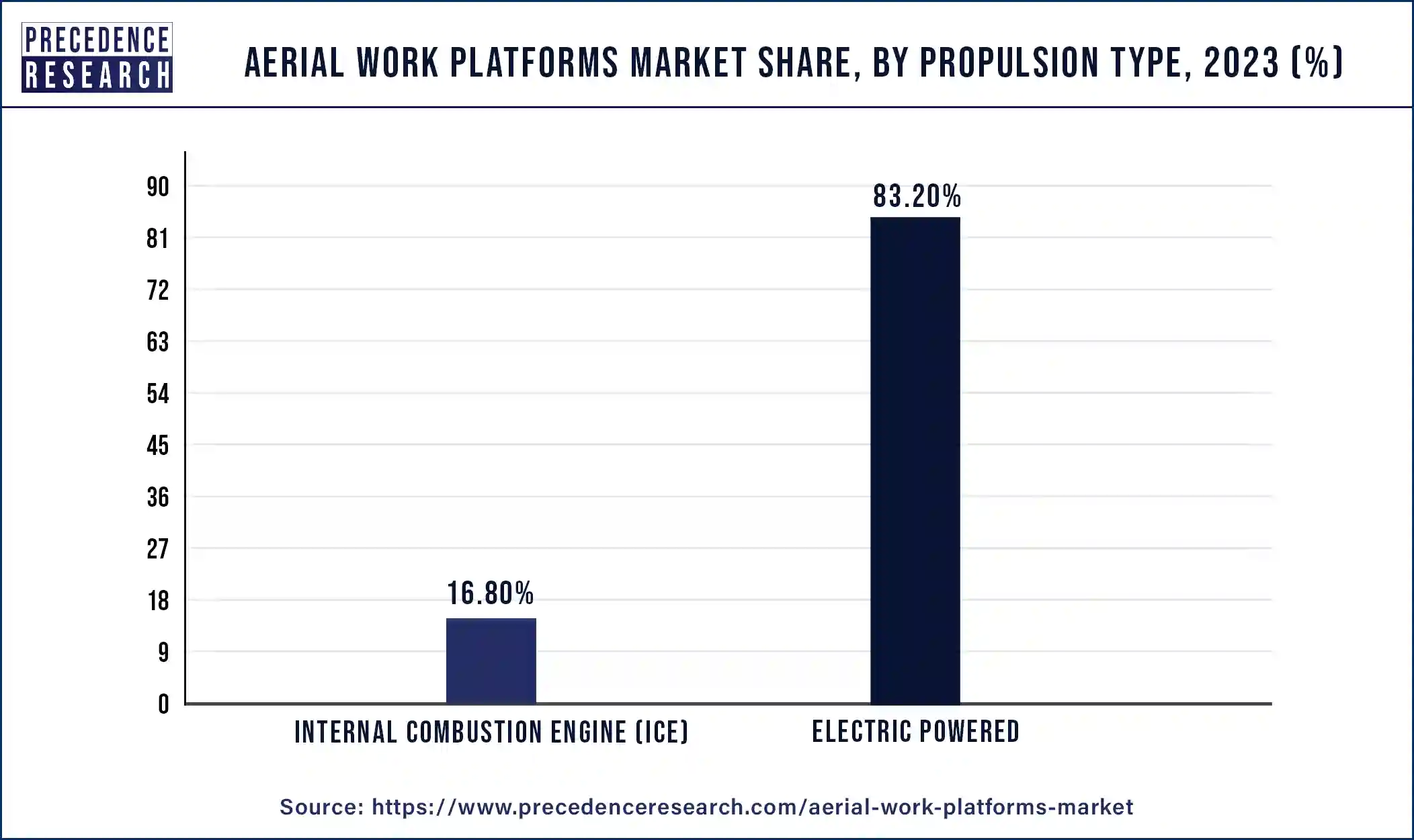

- With the largest market share of 83.20% in 2023, the internal combustion engine category led the market in terms of propulsion type.

- In terms of revenue share in 2023, the scissor lift category contributed about 49.28%.

Get a Sample: https://www.precedenceresearch.com/sample/1083

Aerial Work Platforms Market Growth Factors

The growth of the aerial work platforms market is fueled by several increasing construction and infrastructure development activities worldwide are driving the demand for aerial work platforms for tasks such as building maintenance, painting, and installation.

Secondly, stringent regulations regarding worker safety and the emphasis on reducing accidents at construction sites are encouraging the adoption of aerial work platforms as safer alternatives to traditional methods like scaffolding. Thirdly, advancements in technology, including the integration of telematics and IoT solutions, are enhancing the efficiency and safety of aerial work platforms, further stimulating market growth.

Additionally, the rise of rental and leasing services for aerial work platforms is making these machines more accessible to smaller contractors and businesses, thereby expanding the market reach. Lastly, the growing focus on sustainable practices is leading to the development of eco-friendly aerial work platforms powered by electric or hybrid systems, driving market growth in line with environmental considerations.

Aerial Work Platforms Market Regional Stance

The U.S. aerial work platforms market witnessed robust growth, valued at USD 3.83 billion in 2023 and projected to soar to around USD 10.19 billion by 2033, boasting a notable CAGR of 10.28% from 2024 to 2033. North America held the reins in 2023, commanding a substantial market share of 38.13%.

The United States and Canada, with their flourishing economies and hefty investments in infrastructure, construction, and manufacturing sectors, drove this dominance. Stringent safety regulations, particularly in construction and workplace safety, further bolstered the demand for aerial work platforms.

Meanwhile, Asia Pacific emerges as the epitome of rapid expansion, set to experience the fastest CAGR during the forecast period. With escalating urbanization and a surge in infrastructure investments, the region is witnessing a burgeoning demand for aerial work platforms across various sectors. Governments’ hefty investments in infrastructure development, particularly in transportation networks and ports, are propelling further growth. As such, the Asia Pacific aerial work platforms market, valued at USD 1.64 billion in 2023, is projected to soar with a remarkable CAGR of 13.7% from 2024 to 2033, delineating a promising trajectory for the industry.

Aerial Work Platforms Market Segment Highlights

- End-User Insights:

- Construction segment dominated with 45.53% market share in 2023.

- Aerial work platforms crucial for tasks at elevated heights in construction, maintenance, and cleaning.

- Versatile types like boom lifts, scissor lifts, and vertical mast lifts cater to different needs.

- Maintenance and Cleaning Segment:

- Fastest expansion observed during the forecast period.

- Increasing urbanization and infrastructure development drive the need for regular maintenance.

- Aerial work platforms facilitate tasks like window cleaning, facade inspection, and repair work.

- Sustainability Focus:

- Growing emphasis on eco-friendly alternatives in maintenance and cleaning.

- Electric or hybrid aerial work platforms reduce emissions and environmental impact.

- Propulsion Type Insights:

- Internal combustion engine segment led with 83.20% market share in 2023.

- Robust performance suitable for heavy-duty applications.

- Electric powered segment expected to grow rapidly due to environmental awareness and cost efficiency.

- LGMG Europe’s Electric Boom Lift:

- Telescopic boom lift with electrical power introduced to the market in 2022.

- Tested in China since 2020, now available globally.

- Response to demand for dual lift capacities and wider platforms.

- Types Insights:

- Boom lift segment held 38% revenue share in 2023.

- Sustained growth expected due to impressive height and outreach capabilities.

- Scissor lift segment anticipated to expand fastest, driven by versatility and demand in construction industry.

Aerial Work Platforms Market Dynamics

Driver

The increasing constructional and infrastructural activities serve as significant drivers propelling growth in the aerial work platforms market. As urbanization rates rise and infrastructure development projects escalate globally, there is a growing demand for safe, efficient, and versatile access equipment for working at height.

Aerial work platforms, including boom lifts, scissor lifts, and vertical mast lifts, play a crucial role in facilitating tasks such as construction, maintenance, installation, and repair work at elevated heights. These platforms offer enhanced mobility, stability, and reach, enabling workers to access elevated work areas safely and efficiently. Moreover, with stringent safety regulations and a growing emphasis on workplace safety, there is increasing adoption of aerial work platforms to minimize the risk of falls and accidents associated with working at height.

Additionally, as construction methods evolve and buildings become taller and more complex, there is a greater need for specialized aerial work platforms capable of accessing confined spaces, rough terrain, and high-rise structures. This trend underscores the significant opportunities for growth and innovation within the aerial work platforms market as manufacturers introduce advanced technologies and features to meet the evolving needs of the construction and infrastructure sectors.

Restraint

The lack of skilled labor presents a significant challenge for the aerial work platforms market. Aerial work platforms, vital for construction, maintenance, and various industries, require trained operators to ensure safe and efficient operation. However, the demand for skilled aerial work platform operators often outstrips the available workforce, leading to shortages and impacting productivity and safety on job sites.

Addressing the shortage of skilled labor requires collaborative efforts from industry stakeholders, educational institutions, and government agencies. Investing in vocational training programs, apprenticeships, and certification courses can help develop a pipeline of skilled aerial work platform operators. These programs should cover essential topics such as equipment operation, safety procedures, preventive maintenance, and emergency protocols.

Moreover, promoting career pathways and opportunities in the aerial work platforms industry can attract more individuals to pursue training and certification. Outreach efforts targeting young people, veterans, and underrepresented groups can help diversify the workforce and address labor shortages effectively.

Additionally, technology advancements, such as virtual reality simulators and remote monitoring systems, can supplement traditional training methods and enhance operator proficiency in operating aerial work platforms safely and efficiently.

By addressing the lack of skilled labor through education, training, and technology adoption, stakeholders in the aerial work platforms market can improve workforce readiness, enhance safety standards, and meet the growing demand for aerial work platform services effectively.

Opportunity

The aerial work platforms market exhibits a high dependency on raw material suppliers and vendors, as the availability and quality of raw materials directly impact the manufacturing process, production costs, and ultimately, the competitiveness of aerial work platform manufacturers. Raw materials such as steel, aluminum, hydraulic components, electrical components, and specialized materials for platform construction are essential for the fabrication of aerial work platforms, including scissor lifts, boom lifts, and mast lifts.

One significant factor contributing to the high dependency on raw material suppliers is the specialized nature of the materials required for aerial work platform construction. Manufacturers require high-strength, lightweight materials such as high-grade steel alloys and aerospace-grade aluminum to ensure the structural integrity, stability, and safety of aerial work platforms while maximizing payload capacity and operational efficiency.

Moreover, the global supply chain for raw materials in the aerial work platforms market is often complex and interconnected, with manufacturers sourcing materials from various domestic and international suppliers. Any disruption or delay in the supply of raw materials, whether due to natural disasters, geopolitical factors, or supply chain disruptions, can have significant implications for production schedules, lead times, and overall manufacturing costs.

Furthermore, the quality and consistency of raw materials are crucial considerations for aerial work platform manufacturers, as deviations in material properties or specifications can affect the performance, reliability, and safety of the finished products. Manufacturers must establish strong relationships with trusted suppliers and vendors who can consistently provide high-quality materials that meet industry standards and regulatory requirements.

Additionally, fluctuations in raw material prices and availability can impact the profitability and competitiveness of aerial work platform manufacturers, particularly in periods of economic uncertainty or volatility. Manufacturers may need to implement cost management strategies, such as hedging, inventory management, and supply chain optimization, to mitigate the risks associated with raw material price volatility and ensure a stable supply of materials.

Aerial Work Platforms Market Leading Companies

- CTE

- Aichi Corporation

- Haulotte Group

- Dinolift OY

- Hunan Runshare Heavy Industry Company, Ltd.

- Zhejiang Dingli Machinery Co, Ltd.

- Holland Lift International bv

- JLG Industries

- Hunan Sinoboom Heavy Industry Co. Ltd.

- Niftylift Limited

- Manitou Group

- Snorkel

- Skyjack

- Tadano Limited

- SocageSrl

- Teupen

- Genie

Segments Covered in the Report

By End-User

- Construction

- Maintenance and Cleaning

- Logistics and Transportation

- Manufacturing

- Aerospace and Defense

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Powered

By Platform Working Height

- Below 10 meters

- 10-20 Meters

- 20-30 Meters

- Above 30 Meters

By Type

- Boom Lift

- Articulating Boom Lift

- Telescopic Boom Lift

- Cherry Pickers

- Scissor Lift

- Electric Scissor Lifts

- Rough Terrain Scissor Lifts

- Pneumatic Scissor Lifts

- Atrium Lift

- Z-style Atrium Lift

- S-style Atrium Lift

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1083